Carbon capture and storage has emerged as one of the key technologies to mitigate CO2 emissions. There is broad public support across the globe, but currently CCS is far removed from making a dent in our GHG emissions. Also, the technology has received criticism, most notably on the economic feasibility and keeping the fossil industry in business.

By Lucien Joppen

CCS has become a hot topic, first and foremost because of the Paris agreement. Governments that have signed the agreement, have committed themselves to major CO2 emission reduction targets.

To achieve these goals, the public and private sector need to take various measures such as the shift from fossil feedstocks to renewable forms of energy, such as solar, wind, hydro or nuclear. However, these renewable energy modes take time to build up their share in the energy mix, which endangers the commitments from the aforementioned agreement.

CCS could bridge this gap by capturing CO2 from energy-intensive industries and storing it, either in CO2-depots or to ‘harness’ CO2 in products. The latter form can be described as CCU (Carbon Capture and Utilisation). By employing CCS, countries would also be able to keep and gradually reduce fossil fuels in their energy mix and mitigate CO2 emissions, preferably making use of an existing infrastructure.

Direct and indirect emission

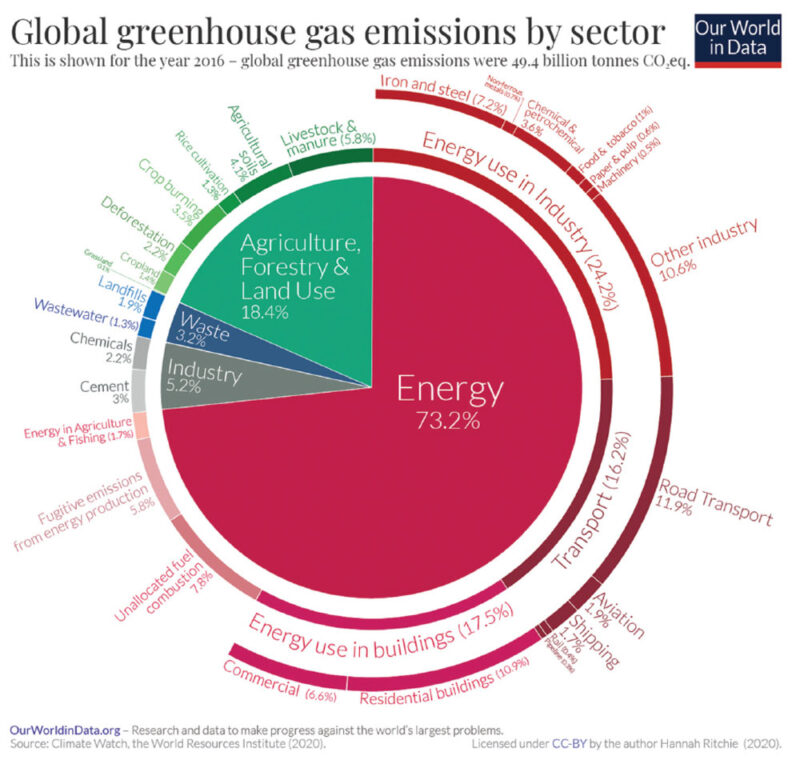

CCS only makes sense from a technological and economical point of view to take place where the most CO2 is generated. Taking a look at the emissions per sector, energy generation (electricity, heat, transport) in general is responsible for almost three quarters of the global CO2 footprint. Zooming into industrial CO2 emissions, these activities take up 25 per cent of global CO2 emissions. Major CO2 emitters are oil/gas/coal industries, iron/steel, cement, fertilizer and (petro)chemical production. Apart from indirect emissions from industrial activities, most notably energy use to power processes, there are also direct emissions from certain processes. For example, cement has CO2 as a byproduct of a chemical conversion process used in the production of clinker, a component of cement. In this reaction, limestone (CaCO3) is converted to lime (CaO), and produces CO2 as a byproduct.

Greenhouse gases are also generated as byproducts from chemical processes such as ammonia production (Haber-Bosch). This CO2 is often used for various purposes such as purifying water supplies, cleaning products, and as a refrigerant, and used in the production of many materials, including plastic, fertilizers, pesticides, and textiles.

CCS’s role in Net Zero Scenario

The potential of CCS for energy-intensive sectors can be significant. The IEA has devised a roadmap intended to support governments and industry in integrating CCS in their emissions reduction strategies. Adoption of this roadmap would enable storage of a total cumulative mass of approximately 120 Gt of CO2 between 2015 and 2050 (according to the Carbon Tracker Initiative, this value would even be higher and equiva-lent to 125 GtCO2). To put this volume into perspective: in 2020, the total global CO2 emissions from fossil fuels were 34.8 GtCO2.

The future will tell if this potential will be used to the full extent. Much depends on the commitments of individual governments or larger entities (such as the EU) to the Paris Agreement and the role they attribute to CCS. Given the prognosis of fossil fuels usage until 2050, which is expected to peak around the middle of this century, CCS is expected to be part of the solution on the mid to longer term. According to IEA’s forecasts, CCS will account for as much as 18 per cent of the emissions reduction needed between 2030 and 2050 in the Net Zero Scenario.

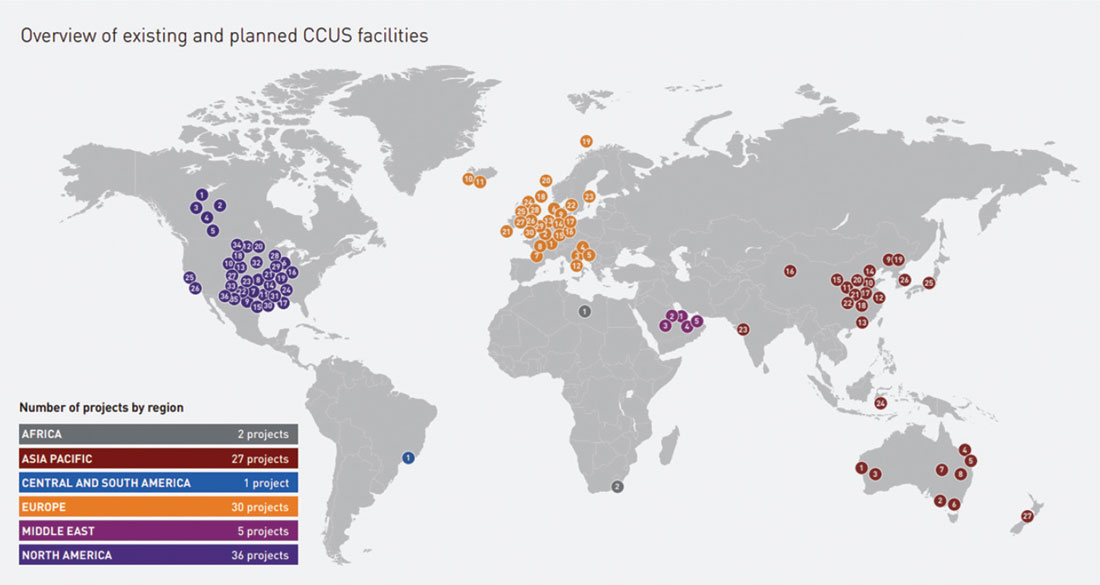

An overview of CCS projects worldwide. A majority of these projects are not operational yet but expected to materialize in the course of this decade.

Currently, the largest CCS plant in operation is the Century Plant with a storage capacity of 8.4mtpa. Sandridge Energy and owner Occidental Petroleum entered an agreement to build and operate the Century CCS facility in 2008. Built with an investment of approximately USD1.1bn, the plant captures CO2 that is used for Occidental’s enhanced oil recovery (EOR) projects in the Permian Basin. The CO2 captured by the facility is delivered to an industrial hub located in Denver City through a 160km pipeline.

EOR momentarily is the preferred business model for CCS plants. As the price of CO2 for EOR is linked to the price of oil, this storage method has been one of the main drivers of CCS deployment in the US.

Source: IOGP

CCS projects picking up

This potential is also reflected in the world-wide activity around CCS in various forms.

“Companies around the globe are increasingly looking to deploy carbon capture and storage technology”, according to a recent ING report. “Companies are acknowledging the huge potential of CCS in strengthening corporate sustainability efforts and decarbonising the global economy and we’re already seeing a steady rise of such projects worldwide.”

As of 2021, the combined capacity of all CCS facilities – operational and under construction – was roughly 40 Mt of carbon dioxide annually. “These projects also feature a growing trend of diversification in both geography and point source capturing.” CCS is categorised according to the class of capture process (post-combustion, pre-combustion, and oxy-combustion) and type of separation technology. In post combustion capture, the CO2 is removed after combustion of the fossil fuel, which would apply to fossil fuel power plants. The technology for pre-combustion is widely applied in fertilizer, chemical, gaseous fuel, and power production. In oxy-fuel combustion, the fuel is burned in pure oxygen instead of air.

Hurdles

The aforementioned CCS capacity of 40 Mt of CO2 is still a drop of water on a hot plate given the potential of the accumulative total storage capacity 120 Gt of CO2 between 2015 and 2050.

As with all emerging technologies, there are several hurdles that need to be taken, mainly in terms of cost and energy penalties, followed by location and capacity of storage sites. Furthermore, CSS requires retrofitting of existing facilities and the establishment of a transportation infrastructure.

There are also several non-technical barriers, including the absence of market mechanisms and incentives and fewer effective mecha-nisms to penalise major CO2 emitting sources, an inadequate legal framework allowing transport and storage (both inland and off-shore) and public awareness and perception. Cost, for now, is the main stumbling block. To be fair, cost estimates are not representative for future project development. First of all, cost estimates on first-of-a-kind projects are only indicative and based on few CCS projects, therefore lacking in empirical data. As stated before, different technologies are involved (point of capture), and the impact of the infrastructure (transport, storage) needs to be taken into account.

US: strong public support

The economic picture for private investors/companies to engage in CCS is highly dependent – at least in the short term – on public support.

Looking at the global picture, the United States government has taken an active role in promoting CCS projects. One major revenue stream is the Internal Revenue Service’s Tax Credit for Carbon Sequestration (Section 45Q), which was enhanced in 2018 to allow industrial players to receive up to USD50/tonne of CO2 that is permanently sequestered and up to USD35/tonne of CO2 utilised.

This commitment has resulted in speeding up CCS project development. During the first nine months of 2021, 36 of the 71 newly added CCS projects worldwide were located in the United States.

Under the proposed Build Back Better bill, CCS projects would be eligible for an USD85 credit per tonne of CO2 stored. However, this bill is currently stalled. However, even if the tax credit would be smaller in the final bill, it would still stimulate CCS deployment.

Giant CO2 hub

Recently, ExxonMobil announced the realisation of a giant, USD100 billion hub to capture carbon dioxide emissions along the U.S. Gulf Coast in Texas. See also our Project Report on Exxon’s blue hydrogen hub on pages 12 and 13). At the announcement, the oil and gas major stated that government funding would be required. “It will need government and private-sector funding, as well as enhanced regulatory and legal frameworks that enable investment and innovation,” Exxon said.

Exxon, along with various private and public partners, would build a facility to collect emissions from refineries, petrochemical plants and other industrial facilities along the Houston Ship Channel.

Such a facility could bury 50 million tons of CO2 a year beneath the Gulf of Mexico by 2030, which would be more than all CCS projects currently operating globally. Exxon said that figure could double by 2040.

Source: Bloomberg

Europe: early adopters

Europe is also an early adopter of CCS. The Netherlands envisions CCS to contribute to 50 per cent of the emissions reduction required in the industry sector. To realise this goal, the Dutch government expanded its energy production subsidy scheme which includes CCS. The UK aims to capture 47 Mtpa of CO2 by 2050 by investing in RD&D, expanding infrastructure, and enhancing financial incentives. Germany, the EU’s largest cement and steel producer, is suited to developing CCS in the long-term with its proximity to the North Sea. The Nordic countries are also active in implementing their CCS strategies. Among others, Norway greenlighted USD1.2bn worth of funding to the Northern Lights CCS project that is led by Equinor, Shell, Total to capture 1.5 Mtpa of CO2 per year.

China: more CCS projects

China has also embraced CCS. The Chinese government has devised a strategy to develop large-scale CCS demonstration projects in its 14th Five-Year Plan (2021-2025). It is estimated that a successful CCS roll-out could curb the country’s emissions by as high as 60 per cent by 2050.

China’s CCS capacity is already rising. An example of new project development is the Guohua Jinjie coal power plant that completed the instalment of a 150,000 tonne/year carbon capture facility. China’s top offshore oil and gas producer, CNOOC, has launched the country’s first offshore CCS project in South China Sea, which is expected to store more than 1.46 million tonnes of carbon dioxide. Other major Chinese oil firms have also been exploring onshore CCS projects. Sinopec is planning a project in east China which is estimated to inject 10.68 million tonnes of the climate warming gas into an oilfield over the next 15 years.

Status quo

For the short to mid-term, the number and capacity of CCS projects is expected to rise, solidifying the position of this technology in the low(er) carbon energy mix. As with many (emerging) technologies, CCS is under fire. It is not only the cost factor, but also the energy that is used to capture, transport and store carbon. Again, cost calculations are still tricky because of the limited number of projects worldwide.

Another point of criticism is that CCS would keep the status quo of the fossil fuel industry intact and that public investment in CCS is going at the expense from investments in renewable energy (wind, solar, other) and other measures, such as reducing energy consumption etc.

In this force field, societal acceptance will be critical, especially when huge public funding is involved. This acceptance is not only important for establishing CO2 storage facilities but also for accepting and supporting CCS in general as a credible and cost-effective measure to offset CO2 emissions.

Valve opportunities

Carbon capture and storage offers ample opportunities for the valve industry as the process needs to transport and contain CO2 in various forms.

Carbon capture and storage offers ample opportunities for the valve industry as the process needs to transport and contain CO2 in various forms.

Especially in the field of carbon capture technology there are openings as there is significant

technology development to increase the efficiency of the process thus reducing energy use and subsequent cost.

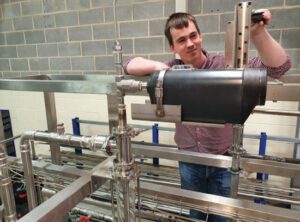

British company C-Capture has patented a unique, solvent-based technology. According to the company, it has developed a safe, low-cost way to remove carbon dioxide from emissions using a post-combustion capture approach. C-Capture was founded in 2009 as a spin-out from the Department of Chemistry at the University of Leeds, and recent investors include IP Group, Drax, and BP Ventures.To help with specifying the parts, C-Capture worked with Scattergood & Johnson, a specialist supplier of electrical engineering and fluid control components.

An in-house test rig involves the flow of the solvent into a wetted wall column. It was important to precisely regulate the solvent flow to enable the collection of accurate test data. The process required an all-electric flow control device, since a pneumatically controlled valve would only add further cost and complexity to the project, both at the pilot stage and beyond. Scattergood recommended the Bürkert Type 3361 2-way globe control valve as the best solution due to its precise and fast flow control.

References

www.iogp.com

Ourworldindata.com

How governments are tempting corporates with CCS: Carbon Capture and Storage. ING Bank (2022)

https://www.burkert.com

Bloomberg.com

An assessment of CCS costs, barriers and potential. Budinis et al (ScienceDirect, 2018).

About this Featured Story

This Featured Story is an article from our Valve World Magazine March 2022 issue. To read other featured stories and many more articles, subscribe to our print magazine.

“Every week we share a new Featured Story with our Valve World community. Join us and let’s share your Featured Story on Valve World online and in print.”