As the environmental scrutiny of LNG intensifies, import taxes on emissions threaten to reshape the global LNG market, creating a premium for low-carbon suppliers and winners and losers among exporting countries.

By Massimo Di Odoardo, Gavin Law, Kateryna Filippenko, Daniel Toleman, Wood Mackenzie

The environmental credentials of liquified natural gas (LNG) are under increasing scrutiny. Despite emitting about half the CO2 of coal when combusted, the LNG value chain remains highly carbon intensive and plagued by methane losses.

In response, LNG players are actively working to reduce the greenhouse gas (GHG) footprint of their projects. With the European Union (EU) extending its Emission Trading Scheme (ETS) to shipping, LNG cargoes into Europe will be subject to a carbon tax from 2024. The EU has further agreed to start monitoring methane emissions of countries and companies and to define acceptable limits for fossil-fuel imports across the value chain. For now, the first draft only refers to new LNG import contracts, but a methane tax on all LNG imports exceeding defined limits cannot be ruled out. The bloc could go further and include LNG in its Carbon Border Adjustment Mechanism (CBAM), setting an import duty at prevailing ETS carbon prices. Such a move will push up European gas prices, bifurcating the global LNG market and creating a European premium, as prices in markets without taxes will be lower. If taxes were limited to the EU, or even extended to Japan and South Korea, trade flows would likely be optimised to mitigate the impact.

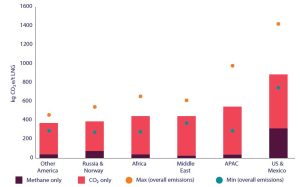

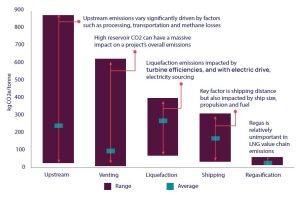

This does not mean that the EU’s moves can be ignored, however. US projects, in particular, will be motivated to reduce their methane emissions as they target higher European prices. But emissions taxes limited to Europe and the mature LNG markets of Northeast Asia alone will be insufficient to motivate LNG players to act decisively to reduce all GHG emissions. Only if widened to the emerging markets of Asia would a substantial tax provide the economic incentive for the industry to invest in more costly abatement options. Wood Mackenzie’s analysis shows that upstream production, and the amount of methane and reservoir CO2 vented, generates the lion’s share of emissions. It also reveals a wide variance in levels of methane emissions. Measured in kgCO2 equivalent, methane only accounts for 5% to 15% of overall carbon intensity in LNG projects outside the US.

But for LNG projects in the US, methane can account for as much as 25% to 40%, due to higher levels of methane losses largely because of the extensive use of pneumatic devices and compressors associated with shale gas production.

The overall carbon intensity of LNG projects also varies significantly by region. Russia and the Middle East are home to some of the least carbon-intensive LNG projects. Construction vintage weighs on emissions in Africa and Asia Pacific. However, with a range of 800 to 1400 kg CO2e/t LNG, the US has some of the world’s highest-emitting projects, with upstream reservoir type and pipeline distance to LNG plants adding to their high methane intensity.

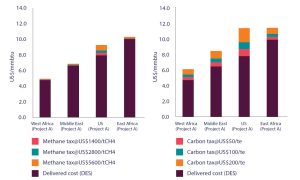

The impact of these emissions on the future delivered cost of LNG projects will depend on how much methane and/or CO2 is taxed. The EU ETS carbon price, used as the reference price in those sectors that already fall within the CBAM, makes it a plausible reference for how the bloc might consider taxing both methane and carbon emissions. The EU ETS price is extremely volatile, though. It traded above US$100/t for much of the last year before dropping to US$50/t recently.. And a future EU ETS price of US$200/t cannot be ruled out as Europe sets increasingly ambitious carbon-emission reduction targets.

The following chart illustrates changes to the LNG cost curve to Europe based on our understanding of current project emissions and assuming a carbon-equivalent tax of US$50/t, US$100/t and US$200/t applied to methane only and to overall GHG emissions.

The big reshuffle of LNG flows

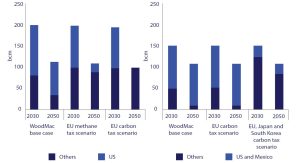

The implications for global gas and LNG dynamics are profound. Gas prices in markets that impose a tax on GHG emissions will inevitably increase, as marginal suppliers need to recover the cost of the additional tax. LNG players with destination flexibility will need to evaluate what strategy maximises their profitability, either focusing on markets without import taxes on emissions or investing to decarbonise and supplying European LNG imports assuming a methane tax of US$2800/tCH4 (equivalent to US$100/tCO₂e) and an overall carbon tax of US$100/tCO₂e Japan and South Korea LNG imports assuming an overall carbon tax of US$100/tCO₂e on Europe only and also on Japan and South Korea premium markets that impose taxes. In addition to prevailing prices and shipping costs, the value of their carbon intensity will come front and centre as LNG players optimise their portfolios. LNG trade flows change dramatically as a result, potentially revolutionising the price-setting mechanism.

Note: Methane taxes of US$1,400, US$2,800 and US$5,600 per tonne of CH4 have been used, equating to taxes of US$50, US$100 and US$200 per tonne of CO2e, respectively, assuming a global warming potential (100-year GWP) of 28, in line with the IPCC Fifth Assessment Report.

Source: Wood Mackenzie LNG Service and Wood Mackenzie LNG Emissions Tool

The results frame a picture of how gas/LNG trade flows and prices would change if GHG emissions from LNG projects were to remain at current levels.

1. The EU imposes an import tax on methane only

The implications for prices are modest. European prices increase by just US$0.6/mmbtu, or 6.5%, as, despite the relatively high tax, methane makes up a small share of overall GHG emissions.

However, with the EU still needing some US LNG, the marginal cargo from North America will continue to set the European price. With the methane intensity of US LNG much higher than elsewhere, this should provide the necessary push for some LNG players in the Atlantic Basin to reduce their methane emissions as they target higher European prices.

2. The EU imposes a wider import tax on all GHG emissions

A wider GHG emission tax will have a material impact, increasing European prices by US$1.7/mmbtu, or 18%. Europe will emerge as the clear premium global LNG market, as US LNG players will require the same netback value they can achieve in Asia. Over time, though, a decline in European LNG demand will mean US LNG being displaced by lower-carbon LNG alternatives, setting the scene for the European price premium to decline. Inevitably, this limits incentives for US LNG and other players to invest to decarbonise.

3. Japan and South Korea also impose an import tax on emissions

Prices in Japan and South Korea increase by some 18%, re-establishing the traditional price premium over Europe. Lower-carbon LNG displace US LNG, although some will still be required to meet demand, resulting in Northeast Asian prices reflecting the full burden of US LNG tax costs in those markets. However, prices in the rest of Asia will see no premium, given the absence of an import tax on emissions.

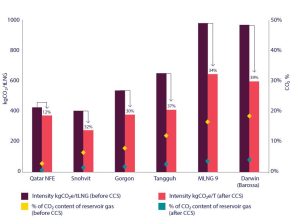

Note: For projects that are planned or proposed (such as NFE, Tangguh, MLNG 9 and Darwin), we assume 80% of the separated reservoir CO2 is sequestered. Source: Wood Mackenzie

What are the options for reducing emissions?

Opportunities to reduce LNG emissions depend on the characteristics of individual projects and relevant carbon prices and taxes. Despite numerous corporate announcements on potential emissions abatement schemes at a wide range of existing and planned LNG facilities, few options deliver sufficient cost-effective emissions reductions to offset the added cost of carbon and methane taxes.

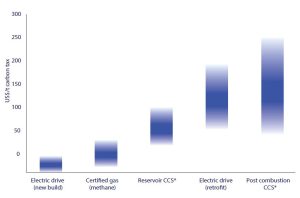

The optimal abatement options broadly fall into four categories:

Methane abatement: US gas producers are already reducing methane emissions from their operations, largely focusing on pneumatic devices and compressors. In line with certification frameworks (such as MiQ), supply from some of the country’s most prolific basins has shown dramatic reductions in levels of associated methane loss and, thus, carbon intensity. In some instances, this has resulted in reductions of up to 40% of upstream emissions (wellhead to transmission) and is one of the most cost-effective options for tackling emissions.

Carbon capture and storage (CCS) of reservoir CO2: For LNG projects with high reservoir CO2 content, venting can be the key driver of emissions intensity and result in some of the highest-emission LNG projects in the world (for example, more than 55% of emissions from the wellhead to LNG loading for Tangguh LNG stems from CO2 venting).

The impact of CCS on projects with high CO2, such as Gorgon and Snohvit, has been considerable, reducing total pre-shipping emissions by around 30%. Future projects that are planning or have proposed CCS – such as Qatar’s North Field East, Tangguh, MLNG 9 and Barossa – could see emissions reductions by around one-third on average.

Electrification: Emissions from the liquefaction process can be reduced by using electric drive turbines powered by low-carbon power supplies from a proximate power grid, providing up to an 80% reduction in liquefaction emissions.

Other options: Several other options that operators are pursuing have a smaller impact or are higher cost. Post-combustion CCS (that is, from the turbine exhaust gases) has been proposed in the US, where the 45Q tax credit is available. Worth up to US$85/t, the credit still falls well short of the cost of most post-combustion CCS developments. Combining this with an import tax on carbon would be a further boost.

The consequence: a two-tier LNG market

LNG emission taxes will shake up the market, creating a two-tier system. Regions with import taxes will see higher gas prices and favor low-carbon LNG suppliers. These suppliers, especially those near premium markets, will benefit. However, the importance of these premium markets may decline over time. Lower taxes (or no taxes) in emerging Asia will create competition. Overall, significant carbon taxes (around $200/ton) are needed to push widespread LNG decarbonization.

About the company

Wood Mackenzie is the leading global provider of data and analytics solutions for the renewables, energy and natural resources sectors. Wood Mackenzie’s services include data, analytics, insight, events and consultancy. The complete whitepaper can be found here: https://www.woodmac.com/horizons/emission-taxes-could-transform-global-lng-market/

About this Featured Story

This Featured Story is an article from our Valve World Magazine, May 2024 issue. To read other featured stories and many more articles, subscribe to our print magazine. Available in both print and digital formats. DIGITAL MAGAZINE SUBSCRIPTIONS ARE NOW FREE.

“Every week we share a new Featured Story with our Valve World community. Join us and let’s share your Featured Story on Valve World online and in print.”