Planning is further complicated by slow construction lead times, which involve lengthy consultation. Also, if an area has suffered drought and desalination plants are built, the risk is that the return of rain will make it look as though the project was a white elephant, at least in the short term. But in the long term, it is fair to assume that demand for desalination will increase sharply. Between 2008 and 2013 capacity jumped by 57%. Whether or not this expansion rate is sustained, technological progress, coupled with increasing demand from the burgeoning mega-cities of developing regions, points to busy times ahead for the desalination industry.

Many of the region’s recent projects are notable for their size (table). In fact, “the world’s largest” is an oft-used, but not always accurate, epithet associated with these projects. In 2005 Ashkelon was the largest SWRO plant, but it was soon overtaken. Fast forward to 2018, and we find that a desalination plant being built at Rabigh, Saudi Arabia, will be almost triple the capacity of Ashkelon. More important than sheer size, though, are the technical advances made possibly by applying economies of scale. At Sorek, for example, the pressure tubes will expand form 8 in. to 16 in., reducing the piping requirement by 75%. Advanced energy recovery technology has been applied at Hadera and in later projects.

This is hampering industrial projects, which are forbidden by law to draw on local water tables and are therefore forced to supply their water. One of the major ongoing projects is taking shape in Tangshan in Bohai Bay, where a desalination plant is being constructed to supply potable water to Beijing, 170 miles away. In January 2016 Black & Veatch announced it has won contracts for two projects, one in Hong Kong and the other in Singapore. Elsewhere is Asia, desalination plants have been announced for in India, Kazakhstan and Bangladesh in the last year.

In Europe, the desalination leader is undoubtedly Spain. The country supplies much of the expertise that makes many of the world’s plants function. It was also the first European country to adopt desalination (Lanzarote, 1964). By 2013, 27 plants had been built, 13 were under construction and work on 11 more was still to start. However, the country has been suffering from over-capacity since the economic crisis of 2007, with desalination caught between rising fuel costs and lack of demand. Nevertheless, Campo Dalías, built by Veolia, was started up in October 2015. It is an RO plant with isobaric chambers that recover up to 95% of the brine pressure which is then transferred to the feed in order to reduce pumping requirements.

For example the CETO system, developed by Carnegie Wave Energy in Perth, Australia, uses submerged buoys actuated by ocean swell to drive pumps that pressurize seawater delivered ashore by a subsea pipeline. Once ashore, the seawater can either drive a turbine to generate electricity to supply an RO plant. As of January 2016 six demo projects have been carried out.

Innovation

Valves and actuators in desalination

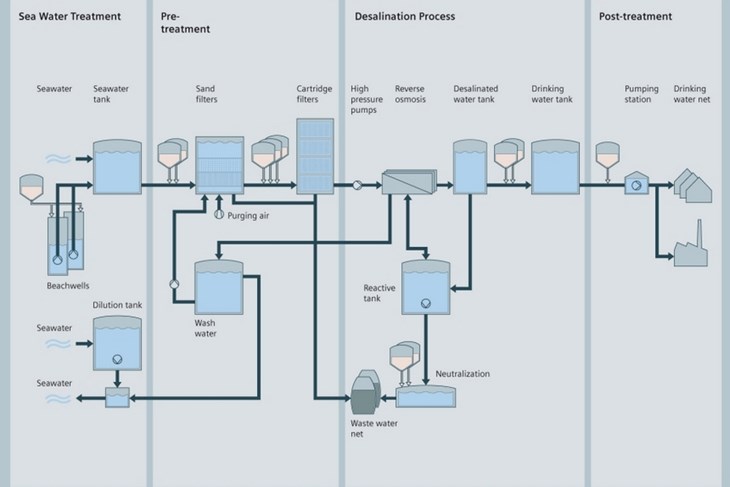

Chemical pre-treatment uses valves ranging from plastic diaphragm and check valves to more robust PTFE-lined plug, ball and butterfly valves. Desalination, in which high-chloride water is pushed at high pressure through the membrane, is the most demanding application. Super duplex stainless steel is required for all wetted parts of the valves, which are typically plug valves. In the final treatment, the brine discharge, which is full of salt, chemicals and metals, requires rubberseated butterfly valves with ductile iron bodies or full port ball valves.

In SWRO technology, a critical role is played by ERDs (energy recovery devices), which can reduce the energy consumed by pumps by as much as 60%. Control valves and various special valves can be installed on these systems. Since designers are constantly seeking to enhance flow efficiency and reduce costs, this may provide scope for innovative products in the field of valves, actuators and other control devices.

Materials used in valves need to be resistant to corrosion, fast flow and cavitation. In the severe environment of the membrane feed process, 300-series materials are inadequate and even materials such as duplex 2205 and austenitic 904L are at risk of failure. Better is a 6%Mo alloy such as 254 SMO, but in recent years it has been found that super duplex (such as SAF 2507) is more cost-effective. Kurt Hilegems, from the Spanish Castflow company which makes valves for desalination estimates his company consumes about ten to 15 tonnes of super duplex per year in valve manufacture. This, he says, is due to the trend of replacing austenitics and superaustenitics with duplex and super duplex steels.

Conclusion

The innovations outlined above show that desalination’s technological evolution is far from over. The advances made in energy and water recovery and in renewable energy use, the economies of scale brought about by large plants and the flexibility and modular structure of small-scale plants are all factors that increase the economic viability of desalination. From the point of view of suppliers, it has to be said that these types of innovation will result in less piping and fewer pumps and valves per output, but this will be offset by the number of projects as desalination is seen to be more attractive.

References

(1) Figures from the International Desalination Association (www.idadesal.org).

To read the complete article, please contact Roy van IJzendoorn for a PDF copy.

___

Did you enjoy reading this web-article?

If you haven’t already, why not subscribe to our magazine?

- About Valve World Magazine: Read more about the Valve World Magazine here

- Subscriptions: Click here to Subscribe