^ Deepwater Projects.

Article by David Sear

___

According to Rystad Energy, South-America accounts for half of the 24 FPSO-projects that have been commissioned in 2019 and 2020. South America leads the pack with 12 sanctioned FPSO projects planned by the end of next year, followed by Asia with four, Europe and Africa with three each, and two more in Australia.

The research agency states that the total amount of 24 projects (on top of the already awarded projects) illustrates a renaissance for the global FPSO-market.

Brazil is set to award seven more FPSO awards in 2020, thereby bringing the country’s total to more than one-third of the awards anticipated globally in 2019 and 2020.

Upswing

“The ongoing upswing in projects points to a brighter future for the FPSO market”, says Audun Martinsen, head of oilfield services research at Rystad Energy. “Offshore operators are finding their footing again after the downturn of 2014, as a robust rise in free cash flow has fueled a significant uptick in deepwater investments.”

According to Rystad, the South-American FPSO-boom is mainly the result of large investments in deepwater exploration and oil and gasfield development. Another important factor has been Brazil’s relaxation of local content regulations, which has opened up the market for international players.

“Brazil’s greater competitiveness on a global scale is a driver behind such huge FPSO awards, along with the region’s recovery from the Car Wash corruption scandal, Petrobras’ debt reduction, substantial pre-salt discoveries and healthier oil prices,” Martinsen states.

More practical solution

As for the FPSO-market in general, Rystad states it also blossoms again due to operational advantages as opposed to less-flexible options. FPSO projects are often more practical than platforms, primarily due to the installation costs and decommissioning challenges associated with fixed platforms. The built-in storage capacity of FPSOs has also proven to be especially advantageous for remote offshore locations, where pipeline infrastructure is not economically feasible.

Martinson: “With improved economic viability resulting from ongoing standardisation measures, coupled with growing deepwater investments, FPSOs are likely to continue to emerge as an attractive development option for many fields in all corners of the world, in both deep and shallow water.”

The FPSO-contractors Yinson and Modec are, due to their strong connections and track record with the E&P-operators, particularly well-positioned to benefit from this upswing through the next wave of contract awards, according to Rystad Energy’s projections.

Market outlook for valves

Rystad Energy is also tracking and forecasting the market for valves and actuators for FPSO-projects.

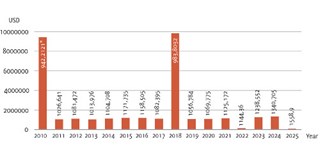

* in million USD