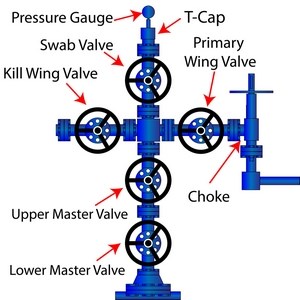

The upstream oil & gas opportunities for valve sales are centered on two primary types of applications: wellhead and pipeline. The former are generally governed by the API 6A Specification for Wellhead and Christmas Tree Equipment, and the latter by the API 6D Specification for Pipeline and Piping Valves.

Wellhead applications (API 6A)

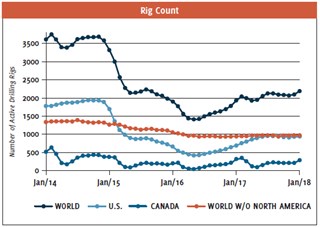

Opportunities for wellhead applications are broadly projected based on the Baker Hughes Rig Count which provides a leading metric for the upstream oil & gas industry. This metric turned positive in 2017, although almost exclusively in North America (see Chart 1). A typical wellhead includes five or more valves that meet the API Specification 6A. These valves are generally of a relatively small size in the range of 1” to 4” for onshore wellheads. The valves may include an upper and lower master valve for well shutoff; a kill wing valve for introduction of various chemicals for flow enhancement, corrosion resistance, and other purposes; a production wing valve for shutoff/isolation of the wellhead from the pipeline system; a choke valve for adjustable throttling of flow from the well; and a swab valve at the top of the tree assembly for vertical access into the well bore.

Valves are generally of the gate or ball type and are selected especially for tight shutoff, resistance to flow erosion, and resistance to corrosion that can be of particular concern for sour crude or sour gas products with high sulfur content. It should be noted that the foregoing discussion excludes subsea valves which are subject to far more demanding service conditions and on a delayed market recovery track because of the higher cost basis for subsea production.

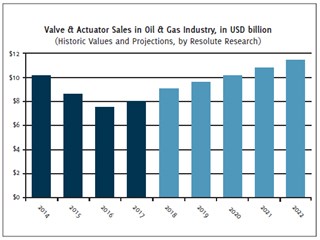

” Global industrial valve and actuator sales growth in 2017 was 7.6 %. (Source: Resolute Research Valve Product Database) “

Pipeline applications (API 6D)

Pipeline applications include mainline valves (MLVs), other valves used in pumping stations for oil and compressor stations for gas, plus valves used for pig launching and receiving, and other miscellaneous applications. Mainline sectionalizing/block valves are generally installed at intervals of every 10–20 miles of pipeline, and at shorter intervals when pipelines cross streams, rivers, and roadways. Compressor stations and pumping stations are generally installed at intervals of 50 miles along the pipeline, but this may vary depending on terrain.

Pipelines may operate at various pressures, but transmission gas pipelines are typically in the 1,000–1,500 psi range, and oil pipelines in the 500–800 psi range. The pumping stations and compressor stations are designed to restore line pressures after pressure loss due to normal flow resistance through the pipe, valves, angles and other restrictions to flow. Accordingly, valves are selected to accommodate the highest pressures coming out of these stations, with an appropriate over-pressure safety margin.

The most common valves are gate valves for oil and refined-product pipelines, and ball valves for gas pipelines. Other API 6D pipeline valves include check valves for the prevention of backflow or mixing of products in a pipeline, and plug valves for special service conditions. Pipeline valves cover a broad range of sizes, ranging from 1” to 10” for gathering pipelines, 12” to 20” for lateral or regional pipelines, and 22” to 48” or larger for major cross-country transmission pipelines. All pipeline sizes are approximate but generally conform to these broad sizing segmentations.

As already mentioned, pipeline valves are generally required to conform to the API Specification 6D which, among other things, requires a full-port design matching the pipeline size to accommodate pipeline ‘pigging’. Pigging involves the passage of a plug-like instrument through the pipe for pipeline inspection and cleaning/maintenance. Pricewise, pipeline valves vary greatly, ranging from approximately USD 1,000 for small gathering-pipeline valves to over USD 100,000 per item for larger transmissionpipeline valves.

The aphorism “a rising tide lifts all boats” may well apply to oil & gas markets, but the rise is not necessarily identical in all geographic regions. A case in point is the upstream oil & gas industry in 2017, where the upturn was most pronounced in North America. This is reflected both in the number of active rigs and in new oil & gas pipeline construction.

The exceptional activity in North America (particularly in the United States) was driven by new wellhead and pipeline requirements. These requirements are related to new wells, plus previously drilled and capped gas and oil wells in the Permian Basin, and the Marcellus and Bakken regions. A relaxation of legislative restrictions on pipelines and the oil & gas industry in general further assisted the recovery in the United States. Increasing demand for natural gas in Mexico has also stimulated pipeline construction from the United States into Mexico, and within Mexico itself over the past several years and into 2017.

This trend is expected to continue through 2020 in North America (U.S. and Canada) and Mexico, as well as to pick up in other world regions including Asia (particularly China and India), the Middle East, and Northern and Eastern Europe. Prime movers driving this market expansion include the continuation of gas and oil shale development in the United States, continued movement of Russian oil & gas into the China markets, and continued activities in Europe aimed at decreasing the current dependency of Europe on Russian gas. Broader use of LNG in various world regions is also driving the expansion of LNG liquefaction plants and regasification plants, along with the necessary gas pipeline infrastructure to and from those facilities.

Pipeline construction in North America

According to the P&GJ’s 2017 Worldwide Pipeline Construction Report, 83,802 miles of pipelines were planned and under construction worldwide at the beginning of 2017, with North America accounting for 31,814 miles, or 38%, of new and planned pipelines. In January 2018, the International Energy Agency (IEA) raised its outlook for U.S. crude supply this year by 260,000 barrels per day (bpd) to a record 10.4 million bpd. If materialized, this forecast would put the United States ahead of Saudi Arabia in terms of crude oil output, making it the world’s second largest oil producer, after Russia.

As North American oil & gas production continues to rise, Canadian crude exports are on the verge of exceeding the country’s pipeline and rail capacity, which is likely to speed up pipeline construction. These are only two of many factors that make North America a world region of largest opportunity for pipeline expansion.

Many of the sales revenue figures as reported by valve manufacturers are now in for 2017, and considerable progress in recouping some of the earlier loses is evident. The latest estimate from Resolute Research indicates an approximate 7.6% increase in global industrial valve and actuator sales over 2016, which is certainly good news for the valve industry, following the disappointments in 2015 and 2016.

The gains in valve sales specifically in oil & gas in North America have been substantially higher than that, reflecting the market drivers discussed above. It is projected that a similar upward trend will be seen in 2018, including a broader distribution of the gains to other world regions.

In view of the growing trend for natural gas to fuel power generation, industrial processes, and residential heating, plus the higher activity in gas pipeline construction, it is anticipated that ball valves will see the greatest benefits in the upstream industry in the near term. However, this is not to discount other valves including gate valves, which will also see welcome market opportunities, although likely on a smaller scale.