^ Wind farm

Article by Lucien Joppen

____

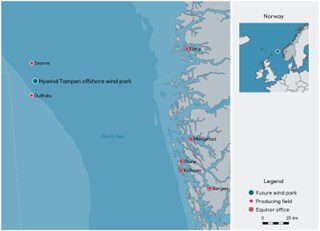

Earlier this year, Equinor (formerly known as Statoil) announced it is considering the project which will be given a final go-ahead or not. The decision will depend mostly on the financing. The project at the Gullfaks and Snorre oilfields, located on the Norwegian Continental Shelf, would cost around 5 billion Norwegian crowns ($592 million). The industry’s NOx-fund has already pledged to invest 566 million NOK, roughly 10% of the total investment. In return, the project (expected to generate 88 MW) could reduce the country’s emissions of carbon dioxide by more than 200,000 tons per year, according to Equinor.

This emission reduction is attributed to the use of renewable energy instead of natural gas-fueled turbines that supply energy to platforms in both oilfields. According to Equinor, these fields provide the ideal location for such a project. It is also a worldwide first for an offshore project in which renewable and fossil energy are combined.

CO2 reduction needed

As mentioned before, the Norwegian government would benefit from lower carbon energy usage. Especially as its greenhouse gas emissions have remained high despite pledges for deep cuts under international accords such as the Paris climate deal. Last year, Norway’s annual emissions were 2.4% above 1990 levels at 52.4 million tons.

“To maintain profitable operations in Norwegian offshore in the long term, it is essential that we do our utmost to further reduce the carbon footprint from our activities,” Equinor’s Executive Vice President Arne Sigve Nylund said.

The other reason for implementing offshore wind is cost reduction by making these renewable energy sources more costcompetitive.

For the time being, floating offshore wind is still in its infancy, although there have been previous attempts to make it work. Based on Equinor’s first floating offshore wind project, off the coast of Peterhead (Scotland), the company estimates it could generate electricity at a cost of approximately 100 euro per MW/h in Hywind Tampen.

Scaling-up key

This would mean a considerable cost reduction (between 40% and 50%) compared to Equinor’s Scottish pilot wind farm. This cost reduction can mainly be attributed to the larger scale: with 88 MW the Hywind Tampen (generating 35% of the total energy consumption at the Snorre and Gullfaks-platforms) is more than double the size of the pilot (30 MW). As mentioned before, scaling-up is key in bringing costs down (CAPEX and OPEX).

As for this particular project, the financial forecast has not been finalized yet. A final investment decision on the project will be made in 2019. Equinor says it hopes that the Norwegian government subsidies would cover half the capital expenditure for the project. Given the country’s track record on reducing CO2 emissions, this investment could pay off, especially if it could stimulate lower carbon technology development and deployment and, at the same time, make a vital sector of the Norwegian economy more cost-competitive.

Word leader in offshore wind

Equinor has high hopes for its Hywind concept. On its corporate website, the company has expressed two ambitions: to bring floating offshore wind to industry scale in 2030 and to further develop Hywind as the most cost-competitive concept.

Equinor believes floating offshore wind can reach 12 GW by 2030, which means that besides Hywind, other floating concepts will get to market. For Equinor it is clear that the project won’t succeed without the combined efforts of technology owners, project developers, suppliers and regulators working together to achieve the necessary scale, innovation and cost reduction.

“We also believe in the need to standardise”, Equinor states on its website. “We will apply learnings from bottom-fixed offshore wind farms, as well as from the oil and gas industry, to further industrialize the Hywind concept.”

In May of this year, Statoil announced the establishment of New Energy Solutions as a separate business area, reflecting the company’s aspirations to gradually complement its oil and gas portfolio with profitable renewable energy and low-carbon solutions.