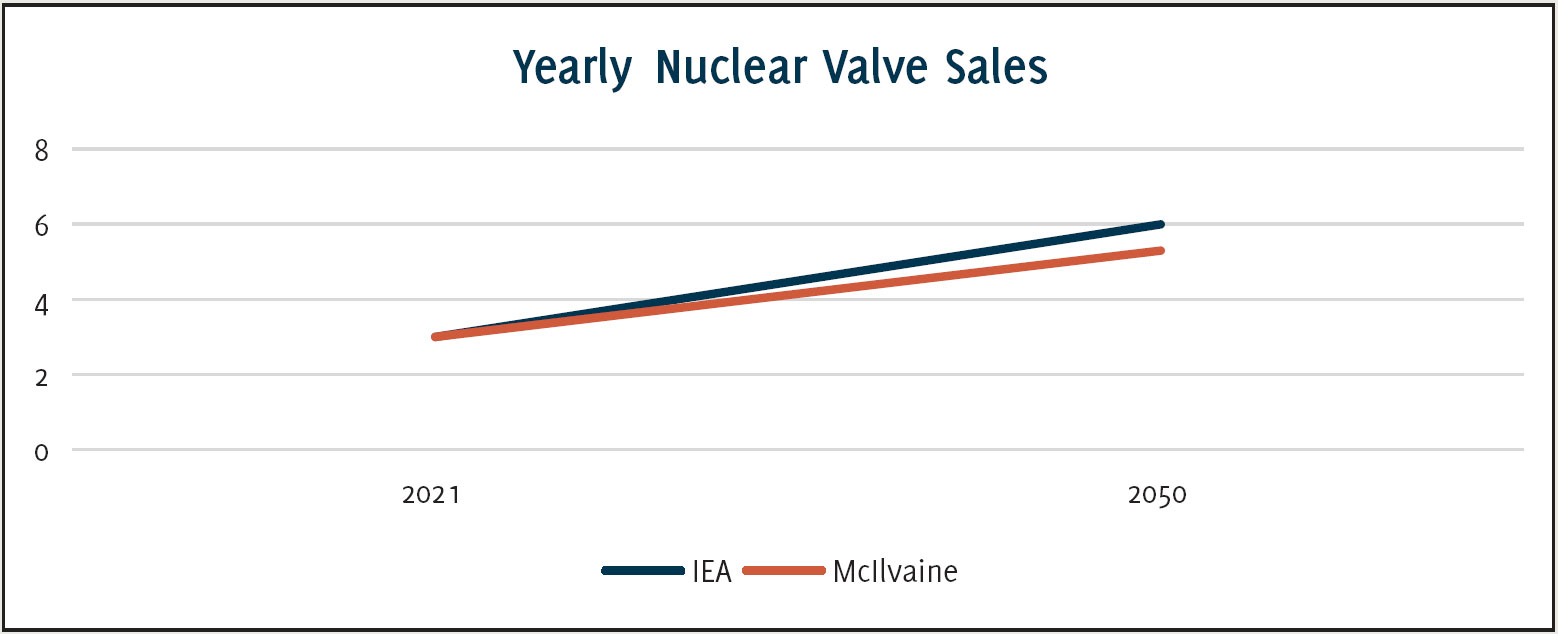

The nuclear valve market is expected to grow from $3 billion in 2021 to $5.3 billion in 2050.(1) A big driver will be the goal of net zero CO2 emissions. Nuclear power is a route to lower greenhouse gas emissions with the advantage of continuous availability.

By Bob McIlvaine

The International Energy Agency has set up a scenario to reach net zero CO2 emissions by 2050. This includes adding nearly 400 GW of new nuclear capacity in the next 30 years.

McIlvaine has its own scenario which anticipates adding 300 GW of nuclear capacity and a higher reliance on biomass with carbon capture (BECCS).

The McIlvaine scenario would also end up with net zero CO2 in 2050 but with a different combination of fuels. BECCS has twice the CO2 reduction impact of nuclear due to removal of CO2 from the air prior to burning and sequestration. Solar and wind have a smaller impact on a net CO2 reduction basis per GW due to their lower capacity factors.

Rising electricity demand

Currently, there are about 445 nuclear power reactors operating in 33 countries, with a combined capacity of about 400 GWe. In 2020 these facilities provided 2553 TWh, about 10 per cent of the world’s electricity. About 50 power reactors are currently being constructed in 19 countries (54,000 MW under construction). About 100 power reactors with a total gross capacity of about 110,000 MWe are on order or planned, and over 300 more are proposed. Most reactors currently planned are in Asia, with fast-growing economies and rapidly-rising electricity demand. As for new reactor development, there are several interesting options, for example SMR’s (small modular reactor). Advanced SMRs are currently under development in the United States, representing a variety of sizes, technology options, capabilities, and deployment scenarios. These SMR’s, varying in capacity from tens of megawatts up to hundreds of megawatts, can be used for power generation, process heat, desalination, or other industrial uses. SMR designs may employ light water as a coolant or other non-light water coolants such as a gas, liquid metal, or molten salt.

Currently, there are about 445 nuclear power reactors operating in 33 countries, with a combined capacity of about 400 GWe. In 2020 these facilities provided 2553 TWh, about 10 per cent of the world’s electricity. About 50 power reactors are currently being constructed in 19 countries (54,000 MW under construction). About 100 power reactors with a total gross capacity of about 110,000 MWe are on order or planned, and over 300 more are proposed. Most reactors currently planned are in Asia, with fast-growing economies and rapidly-rising electricity demand. As for new reactor development, there are several interesting options, for example SMR’s (small modular reactor). Advanced SMRs are currently under development in the United States, representing a variety of sizes, technology options, capabilities, and deployment scenarios. These SMR’s, varying in capacity from tens of megawatts up to hundreds of megawatts, can be used for power generation, process heat, desalination, or other industrial uses. SMR designs may employ light water as a coolant or other non-light water coolants such as a gas, liquid metal, or molten salt.

Lifetime extension

Looking at other important markets for nuclear energy, it looks like many countries are cautious and opt for extending the life cycle of existing nuclear power plants. Most nuclear power plants originally had a nominal design operating lifetime of 25 to 40 years, but engineering assessments have established that many can operate longer. In the United States, traditionally a strong-hold within the nuclear power generation sector, the NRC (Nuclear Regulatory Commission, USA) has granted license renewals (in 2016) to over 85 reactors, extending their operating lifetimes from 40 to 60 years. Such license extensions at about the 30-year mark justify significant capital expenditure needed for the replacement of worn equipment and outdated control systems.

Looking at other important markets for nuclear energy, it looks like many countries are cautious and opt for extending the life cycle of existing nuclear power plants. Most nuclear power plants originally had a nominal design operating lifetime of 25 to 40 years, but engineering assessments have established that many can operate longer. In the United States, traditionally a strong-hold within the nuclear power generation sector, the NRC (Nuclear Regulatory Commission, USA) has granted license renewals (in 2016) to over 85 reactors, extending their operating lifetimes from 40 to 60 years. Such license extensions at about the 30-year mark justify significant capital expenditure needed for the replacement of worn equipment and outdated control systems.

In France, there are rolling ten-year reviews of reactors. In 2009, the Nuclear Safety Authority (ASN) approved EDF’s safety case for 40-year operation of its 900 MWe units, based on generic assessment of the 34 reactors. There are plans to take reactor lifetimes out to 60 years, involving substantial expenditure.

Meanwhile, the Russian government is extending the operating lifetimes of most of the country’s reactors from their original 30 years, for 15 years, or for 30 years in the case of the newer VVER-1000 units, with significant upgrades.

Service type

Present expenditures for nuclear valves are $3 billion per year rising to $6 billion/yr in 2050 for a CAGR of just over 2 per cent/yr in the IEA scenario. In the McIlvaine scenario the nuclear valve market only grows to $5.3 billion in 2050.

Present expenditures for nuclear valves are $3 billion per year rising to $6 billion/yr in 2050 for a CAGR of just over 2 per cent/yr in the IEA scenario. In the McIlvaine scenario the nuclear valve market only grows to $5.3 billion in 2050.

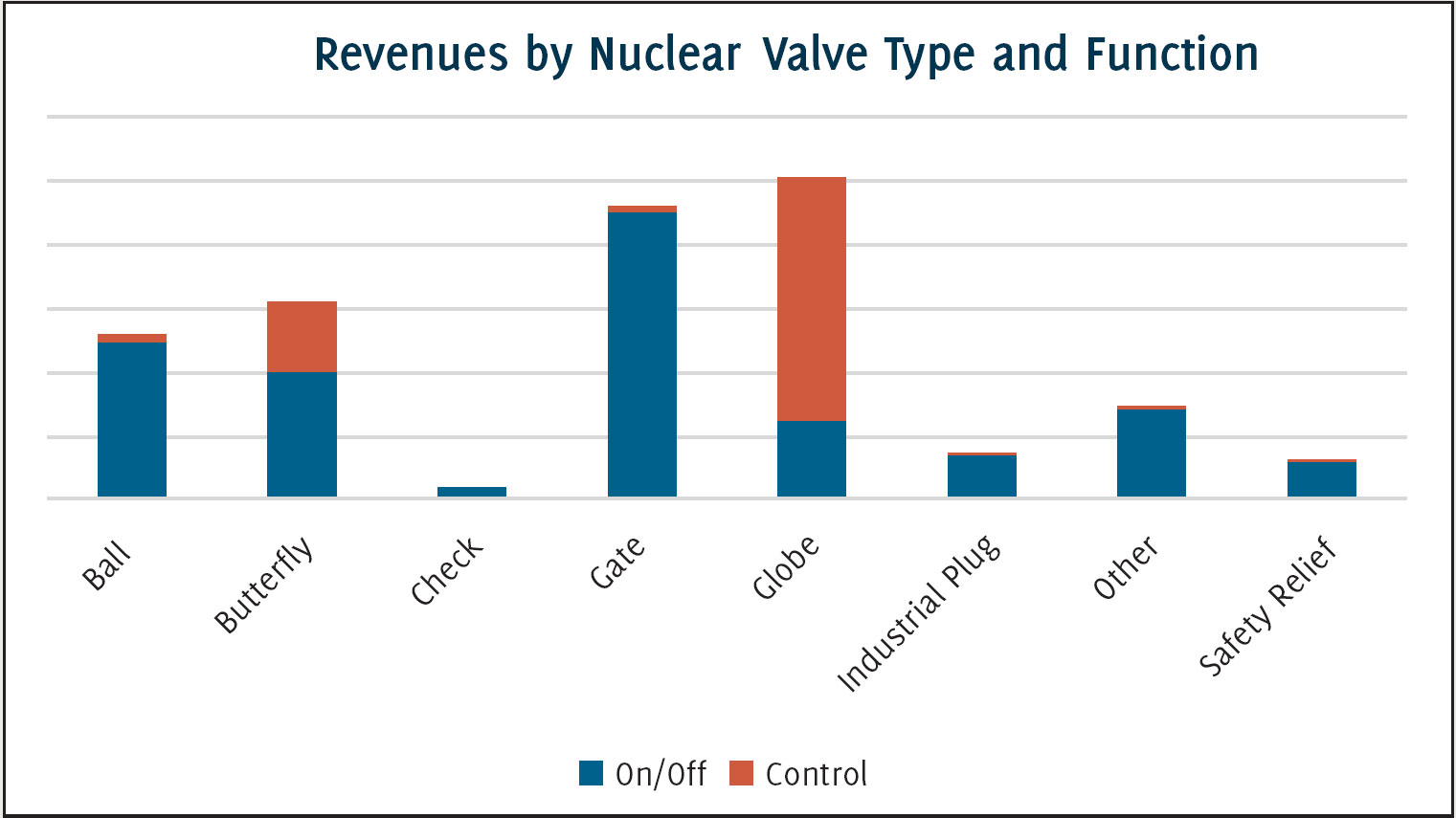

The present market is served by a limited number of suppliers who have been able to meet the industry’s stringent regulatory requirements. One segmentation is by isolation versus control. Another is by valve type. A very important segmentation is by service type. Many valves are in critical service in which case a valve malfunction can result in considerable harm to human and environmental health. Others are in both critical and severe service but included under severe service. Some are in ‘unique service’, meaning these are engineered valves designed to perform under specific conditions. General service valves in the nuclear industry include service valves such as water intakes.

All in all, the market for replacement valves, repair parts and service is far bigger than for new valves. Sales of new valves for new plants represent less than 10 per cent of the total. The other 90 per cent is replacement valves, repair parts and service supplied by the valve manufacturer. Not included are expenditures for condition/remote monitoring and other services. Given the emphasis on life time extension in mature markets, it can be expected that the market share of replacement/repair will only grow.

Premature decommissioning

The above development makes sense as the technical and economic feasibility of replacing major reactor components, such as steam generators in PWRs, and pressure tubes in CANDU heavy water reactors, has been demonstrated.

The above development makes sense as the technical and economic feasibility of replacing major reactor components, such as steam generators in PWRs, and pressure tubes in CANDU heavy water reactors, has been demonstrated.

The possibility of component replacement and license renewals extending the lifetimes of existing plants is very attractive to utilities, especially in view of the public acceptance of difficulties and high project costs involved in constructing replacement nuclear capacity.

On the other hand, economic, regulatory and political considerations have led to the premature closure of some power reactors, particularly in the USA, where reactor numbers have fallen from a high of 110 to 94, as well as in parts of Europe and likely in Japan.

To conclude, the market for nuclear valves is substantial and is growing but at a rate lower than the GDP. However, due to the critical service requirements the potential for relatively high margins is substantial.

(1) Industrial Valves: World Markets – published by the McIlvaine Company.

About this Featured Story

This Featured Story is an article from our Valve World Magazine October 2021 issue. To read other featured stories and many more articles, subscribe to our print magazine.

“Every week we share a new Featured Story with our Valve World community. Join us and let’s share your Featured Story on Valve World online and in print.”