By Lucien Joppen

In recent years, Rotork has reorganized its company structure. These changes were largely to increase the focus on end-user markets and to ensure Rotork was easier to do business with. From four product-centered divisions, Rotork moved to a market-oriented structure, focusing on oil and gas, water and power, and chemical, process and industrial (CPI). This change is already having an effect, according to Rotork’s Lyndsey Norris and Andy Filkins.

Valve World interviewed Lyndsey Norris, Managing Director, CPI and Andy Filkins, Head of Strategy, CPI, on Rotork’s journey. Lyndsey joined Rotork in August 2018 as a Divisional Finance Director (initially for the Instruments division) before moving into the role of Divisional Finance Director, CPI.

In June 2021, Lyndsey joined the Rotork Management Board as Managing Director, CPI. Prior to joining Rotork, Lyndsey spent 21 years at IMI Precision Engineering (a division of IMI Plc) holding numerous senior finance roles including Global Operations Finance Director and Regional Finance Director where she focused on the industrial automation, energy, commercial vehicle, and life science sectors.

Andy Filkins started his Rotork career in 2014 as General Manager at Rotork Midland before taking the role of Business Development Director of Rotork Instruments. He has over 30 years of experience in the industrial engineering sector.

Technological leadership

To look to the future, we begin with looking at the past. In 2019, Valve World interviewed former CEO Kevin Hostetler. In this article, Hostetler made it clear that Rotork was renowned for its “technological leadership in electric actuation and instrumentation, reliability and global presence”. However, he felt that there was room for improvement, based upon conversations with the board and discussions with key stakeholders across the business. With Kevin at the helm, Rotork aimed to improve both at the front and back end of the organization. Lean manufacturing, supply chain management optimization, enhanced IT infrastructure and a more market-oriented organizational structure were areas for development. By aligning key account management teams with market-facing sales teams, Rotork would be able to streamline sales and communication channels to make it easier for customers to receive the right advice and product solutions.

Pride in achievements so far

“The relatively new organizational structure has been established to move even closer to our end-user markets and customers”, said Norris. “We have put this structure in place and are now approaching the market as three end markets. The aim is to enhance the customer relationship and solidify our customer relationship via dedicated client managers who can offer the full solution to the customer. Now the emphasis is not so much about selling products but more about recognizing customer value and looking at specific solutions – above and beyond.” Norris said that Rotork has put a lot of time and effort to prepare the company, both in terms of human and physical resources, for this operation. Actions such as sales training, the development of internal IT tools and restructuring production by consolidation have been developed and integrated into the company. “I am extremely proud of the Rotork workforce and what has been achieved so far. Of course, we’re not there yet. It is a journey that will make us better prepared for the imminent future.”

Accelerated growth

The above organizational changes followed directly from Rotork’s Growth Acceleration Programme (GAP), which in turn can be translated back to the company’s overall strategy. This strategy rests on three pillars: accelerated growth (organic, acquisitions, optimization of supply chain and production), increased margins (simplifying the core business, targeted manufacturing improvements and development of global supply chain), and sustainability.

“Our Growth Acceleration Programme is designed to deliver sustainable mid to high single-digit revenue growth and mid-20s adjusted operating margins over time. The program is not about transforming Rotork, but rather refining how we do things, building on our strong foundations,” the company states on its website.

“We already have the expertise and knowledge/insights into our end-user markets,” said Filkins. “However, we need to move even closer and listen more intently to where the value lies for our customers and their customers. By doing so, we will be able to make better informed decisions in terms of new product development and services. As we speak, we are conducting an extensive customer review with the assistance of a third-party, carefully analyzing the interviews, preferably reading between the lines.”

The four pillars of the Growth Acceleration Programme

Rotork has grouped the GAP into four pillars: commercial excellence, operational excellence, talent and culture, and IT and core business processes.

Commercial excellence encompasses various aspects, such as sales force optimization, increased focus on end-markets, value selling training, and innovation and new product development.

Operational excellence is directed at manufacturing (“lean”), supply chain management and improving Rotork’s environmental footprint.

Talent and culture is about culture (a “can-do” mentality), internalizing performance appraisal and review processes, and aligning strategy, goals, behaviors and rewards systems.

Finally, IT/CBP changes are needed to improve and standardize core business processes, enabling back-office leverage and generation of operating efficiencies. The company has adopted an ERP/Windows 365-system to carry these optimizations throughout its organization.

Quick rebound

Looking at Rotork’s core end-user markets, oil and gas took quite a hit in 2020 through the start of the pandemic, severely impacting mobility and related industries. Norris said: “Luckily, we are witnessing a reviving sector with new projects being developed. We still have to see how this revival will materialize in 2022. CPI also took a hard and quick hit in 2020 but also quickly bounced back. We are very hopeful to get back to the sales levels of 2019. Within water and power, it was a bit of the mix of the two, with some promising projects still online. Water and power have proven more stable sectors, which makes these less susceptible to market disruptions even given the size of COVID-19.”

Filkins adds: “Rotork is focused on markets that were more or less severely impacted. COVID-19 hit us like many other companies. However, we were sufficiently resilient to weather the storm. As Lyndsey mentioned, the prospects for 2022/2023 are looking better, with the situation around COVID-19 improving. Asia has more or less come out of the pandemic. It is business as usual with companies having welcomed back their employees full-time.”

Green hydrogen

Rotork has a focus on renewable energy, with waste-to-energy, biomass, hydro-electric and green hydrogen all under the company’s purview. With global attention on and subsequent investments in various parts of the (green) hydrogen supply chain, this market could prove to be promising. “We have established a dedicated team around green hydrogen,” Filkins said. “We are not starting from scratch as we already have a comprehensive portfolio of actuators, instrumentation and control devices to service the entire supply chain from the generation of renewable energy to the delivery to the consumer. Hydrogen is not the easiest of mediums to store and transport. Safety, operational efficiency and reliability are key requirements which we are able to fulfill due to our experience and knowledge of the hydrogen supply chain.”

Focus from capacity building to flexibility

The chemical industry, part of Rotork’s CPI division, has been affected badly by the pandemic but also has shown signs of an early recovery. Filkins explains the background of the sector’s challenges.

“Even before COVID-19 hit, the sector has been investing in production facilities for ethylene to a point where the industry knew that overcapacity was looming in three to four years’ time. Right now, the industry is not playing the capacity/volume game but focusing on flexibility and efficiency. There is still a capacity factor in the market, but there is a realization that profitability lies in other market segments with less emphasis on volume and more on value. There are also implications for our business. For example, digitalization is needed for better process control to increase output and to switch production processes more often because of more flexible production strategies.”

Precise control, fail-safe, robust

Rotork is already working with major producers such as AREVA H2GEN. This company has developed PEM technology as part of a water electrolysis process to produce carbon-free hydrogen. Each electrolysis skid is equipped with Rotork CVL actuators which are mounted on globe valves. They regulate the pressure and level of the water that is at the heart of the process, providing the necessary precise control.

CVL-500 actuators have high movement frequency and quick reactivity, while the fail-safe functionality (using built-in supercapacitors) of the actuators was important to prevent potential disaster on the loss of power. The ATEX IIC certification of CVL actuators was a further requirement; this is essential in an environment where hydrogen is present.

Methane under the spotlight

Green hydrogen is a topic that perfectly aligns with oil and gas and energy-intensive process industries that need to decarbonize. Filkins said: “Another big issue is emission reduction; whether it is CO2, methane or volatile components, it will be a huge topic for years to come. Governments and industries, sectoral and individual, have pledged to reduce greenhouse gas emissions to get to the CO2 emission targets that are outlined in the Paris Agreement. Along with carbon taxation, these are incentives for all stakeholders to walk the walk. Specifically, methane reduction is needed as the demand for natural gas is expected to increase as the ’cleanest’ fossil fuel. However, methane is a far more potent greenhouse compared to carbon dioxide, although it breaks down faster in the atmosphere. In the short term, methane contributes relatively more to global warming.”

Electrification

There are various sources – anthropogenic and natural – that cause methane emissions. Agriculture and the energy sector are the largest man-made emitters. “In the energy supply chain, part of the methane escapes via leaks and from venting of methane-powered pneumatic devices. Changing over to electric actuators will eliminate this practice,” said Filkins. This switch from pneumatic devices to electric actuators not only saves on emissions but also on energy. “Electric devices use up far less energy, therefore contributing to a lower CO2 footprint. It is also true that many sectors are sticking to what they are accustomed to. However, we are persistent as we are convinced that electric actuation offers a better overall performance. This performance benefit not only applies to on/off, open-close valve types but also to control valves.”

Carbon capture

Energy intensive industries also have the option to reduce their CO2 footprint by capturing carbon and storing it (or storing and eventually using it (Carbon Capture, Usage and Storage [CCUS]).

“CCUS is a growing market as it offers hard-to-abate sectors the possibility to compensate for their CO2/methane emissions,” said Norris. “Processes for CCUS are flow control equipment intensive, requiring large numbers of control and on-off valves as well as intelligent electric actuators and related network control systems. Our advanced products are already used in many of the world’s CCUS facilities.”

In Europe, Rotork is heavily involved in the Northern Lights project, which is a joint-venture between the Norwegian government, Equinor, Shell and Total. The Northern Lights project is part of the Norwegian full-scale CCUS project. The full-scale project includes the capture of CO2 from industrial facilities in the Oslo fjord region (cement and waste-to-energy) and shipping of liquid CO2 from these industrial capture sites to an onshore terminal on the Norwegian west coast.

“Our Intelligent Asset Management system helps to improve our

customer performance and competitiveness. This is where we can add real value”

Intelligent Asset Management

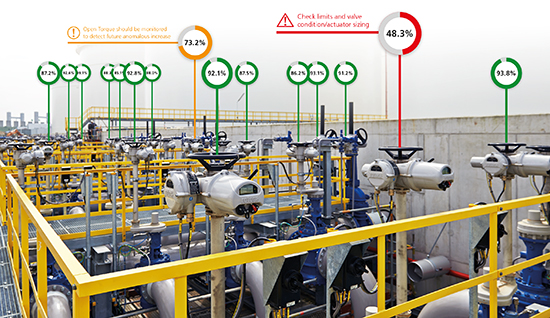

At the end of the interview, Norris stresses the importance of data capture and analysis. “Digitalization has made a huge impact on all business sectors and it increasingly will impact the sectors Rotork is operating in. We are perfectly positioned to play a key role in this evolution as our actuators collect large amounts of data that can be analyzed for various purposes, for example, for equipment status or maintenance. We are incredibly excited to take our customers on this journey.” Central to Rotork’s approach towards data-based asset management is Intelligent Asset Management.

This is a cloud-based system that works across multiple operating systems. Temperature, vibration and torque data is taken from an intelligent actuator’s data logger and presented in easy-to-understand visuals, with summary views and color-coded maps. “The system can translate complex information into simple and accessible reports,” said Filkins. “Operators are then fully informed and able to make proactive decisions. Predictive maintenance ultimately reduces unplanned downtime and increases productivity. Specifically for CPI, data analysis can also be used for optimizing process efficiency. Ultimately, the Intelligent Asset Management system helps to improve our customer performance and competitiveness. This is where we can add real value.”

It is clear that Rotork’s recent changes in structure bring the company closer to its customers. The realignment of market focus has allowed the flow control company to better identify customer requirements and needs, while innovation in the digitalization sector provides customers with an in-depth understanding of the performance of their actuators. Sustainability and emissions reduction remain key areas of focus for Rotork, both in how they operate and how their products assist customers in improving their environmental performance.

About this Featured Story

This Featured Story is an article from our Valve World Magazine February 2022 issue. To read other featured stories and many more articles, subscribe to our print magazine.

“Every week we share a new Featured Story with our Valve World community. Join us and let’s share your Featured Story on Valve World online and in print.”