The growing demand for water is mainly driven by population growth, which stimulates water consumption in various ways: as drinking water but also in agriculture, industry and power generation. Due to increased regulation and higher cost, municipalities and industries try to minimize waste water volumes and focus on waste water reuse.

By Bob McIlvaine

Freshwater scarcity, one of the most critical global challenges of our time, poses a major threat to economic growth, water security, and ecosystem health. The challenge of providing adequate and safe drinking water is further complicated by climate change and the pressures of economic development and industrialization.

The public and industrial sectors consume substantial amounts of freshwater while producing vast quantities of wastewater. If inadequately treated, wastewater discharge into the aquatic environment causes severe pollution that adversely impacts aquatic ecosystems and public health.

Recovery and recycling

Recovery and recycling of wastewater has become a growing trend in the past decade due to rising water demand. Wastewater re-use not only minimizes the volume and environmental risk of discharged wastewater, but also alleviates the pressure on ecosystems resulting from freshwater withdrawal. Through reuse, wastewater is no longer considered a “pure waste” that potentially harms the environment, but rather an additional resource that can be harnessed to achieve water sustainability.

Communities across the country are incorporating water reuse into their water management strategies as a proven method for ensuring a safe, reliable, locally controlled water supply-essential for livable communities with healthy environments, robust economies and a high quality of life. By 2027, the volume of recycled water produced in the United States is projected to increase 37 per cent from 4.8 billion gallons per day to 6.6 billion gallons per day.

Zero liquid discharge

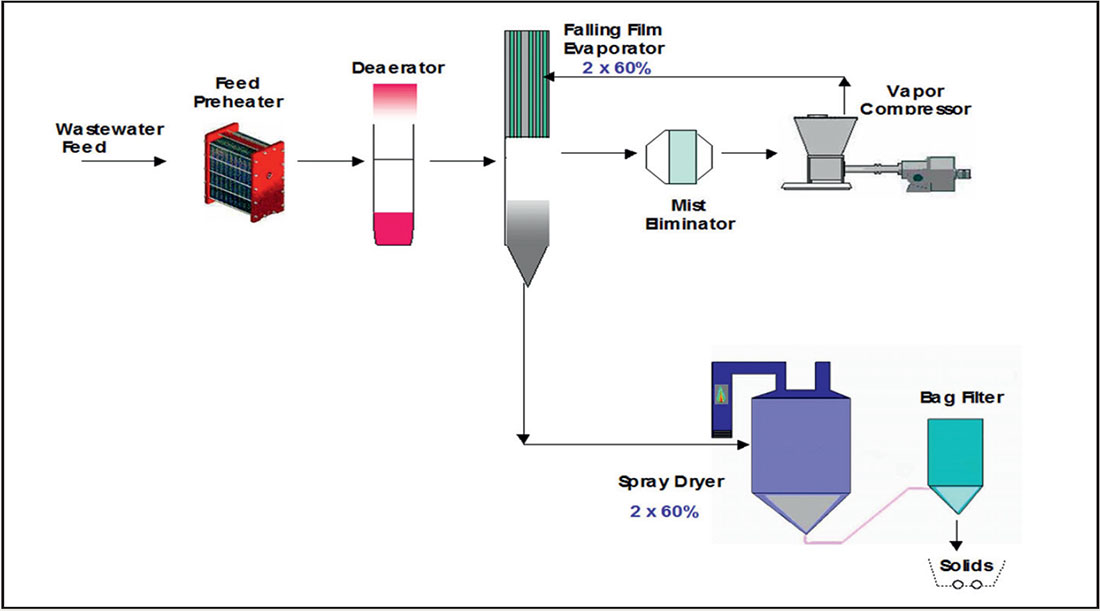

Zero liquid discharge (ZLD) eliminates any liquid waste leaving the plant or facility boundary, with the majority of water being recovered for reuse. There are several approaches to achieving ZLD; one involves reverse osmosis and evaporation. ZLD obviates the risk of pollution associated with wastewater discharge and maximizes water usage efficiency, thereby striking a balance between exploitation of freshwater resources and preservation of aquatic environments. More stringent regulations, rising expenses for wastewater disposal, and increasing value of freshwater are driving ZLD to become a beneficial or even a necessary option for wastewater management.

U.S. investments

The U.S. is expected to spend $100 billion per year on municipal water and wastewater capital equipment and repairs over the next 10 years. This will be largely funded by states and localities. Federal funding has dropped below $4 billion per year. The Biden infrastructure bill will allocate $55 billion for water infrastructure. This funding includes $15 billion for lead pipe replacement, $10 billion for chemical clean-up, and money to provide clean drinking water in tribal communities. The net impact will be only a few billion dollars of additional water and wastewater infrastructure funding per year in the new legislation.

The U.S. market takes up roughly 20 per cent of the global municipal market. The world municipal market is growing at 4 per cent per year whereas the U.S municipal market will be only growing at 3 per cent per year.

Areas of growth for water recycling include:

• Agricultural reuse • Onsite non-potable water systems • Industrial reuse • Environmental restoration • Potable (drinking water) reuse

• “Produced water” from oil and gas production • Stormwater capture and reuse

High-performance

From a global perspective, the global industrial market is more promising, with a growth rate of 7 per cent per annum. This high growth industrial market includes zero liquid discharge (see box text on page 52) and wastewater re-use. As mentioned before, the sanitation and re-use of water is an interesting growth market. Wastewater re-use also involves a bigger investment in high performance valves than normal wastewater treatment. It can involve evaporation and reverse osmosis which require special valve designs.

One of the biggest present and potential uses is the power industry. In China, re-use of municipal wastewater from power plants is standard practice. In the U.S., municipal wastewater sources are convenient. The average power plant is within 70 miles of a municipal wastewater plant.

This use of power plant heat involves a spray drier and a critical valve to control slurry injection into the dryer.

To conclude, the market for valves for water and wastewater will be driven by population growth which will increase total use. A bigger driver, however, will be the water scarcity which is in part due to climate change but also do to previous water management practices.

1. Industrial Valves: World Markets – published by McIlvaine Company

About this Featured Story

This Featured Story is an article from our Valve World Magazine April 2022 issue. To read other featured stories and many more articles, subscribe to our print magazine.

“Every week we share a new Featured Story with our Valve World community. Join us and let’s share your Featured Story on Valve World online and in print.”