The German industrial valves sector achieved only a slight increase in sales of 1 percent in 2021. While domestic business stagnated, foreign sales grew by 1 percent. Only business in the euro-zone recovered strongly, climbing 11 percent. The first signs of 2022 are more encouraging, according to VDMA.

By VDMA Valves – Article first published April 2022

“As expected, the past year produced only slight growth for German manufacturers of industrial valves. Nevertheless, against the background of the previous year, the industry can be satisfied”, according to Wolfgang Burchard, Managing Direc-tor of VDMA Valves.

However, in the course of the year, order books filled up. “Due to material shortages and supply bottlenecks, manufacturers have not yet been able to process numerous orders”, Burchard points out. “Here, however, we expect the order backlog to be cleared quickly in the course of this year.”

Control and safety valves with sales growth

The individual product groups again developed quite differently in 2021, the VDMA states. Control valves as well as safety and monitoring valves posted a significant increase in sales. In the case of control valves, domestic sales grew by 4 percent and international business by 11 percent. For safety and monitoring valves, domestic sales climbed by 3 percent and foreign sales by 7 percent. For shut-off valves, the year was rather disappointing, with sales down 6 percent overall. Domestic sales shrank by 5 percent and foreign business decreased by 6 percent. According to VDMA figures, order intake in all three sectors is currently higher than in the same period of the previous year.

Exports recovering

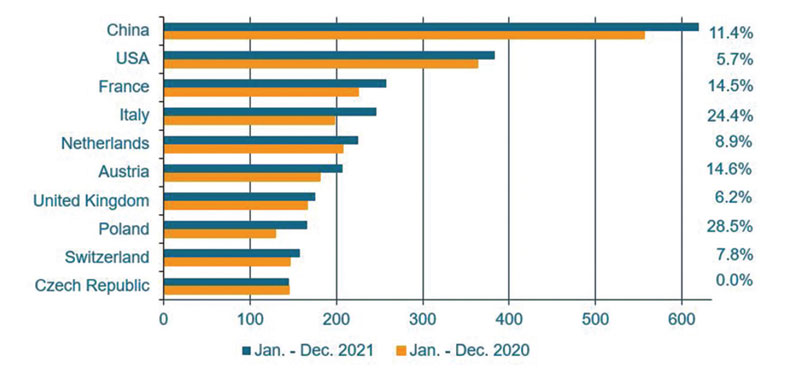

After the weak previous year due to the pandemic, the export business recovered quickly in 2021. Industrial valves worth around 4.5 billion euros were exported abroad. This corresponds to an increase of 9.5 percent compared with the previous year. Exports are thus slightly above the pre-crisis level of 2019.

Export business with China, the company’s most important trading partner, has picked up speed rapidly and, at plus 11.4 percent, is well above the previous year’s level. Valves worth 619.7 mil-lion euros were shipped to the People’s Republic. By contrast, exports to the USA, the second most important customer country, rose by only 5.7 percent to 383.2 million euros. This is still well below the pre-crisis level of 436.4 million euros.

Italy standing out

Exports to France increased by a strong 14.5 percent. The country thus continues to hold third place among the most important sales markets with a volume of 257.6 million euros.

Italy still stands out positively among the most important customer countries, according to the VDMA. Exports to Italy climbed 24.4 percent to 245.9 million euros, reaching a level well above the 2019 result (204.9 million euros). Deliveries to Poland were also significantly higher, up 28.5 percent. At 166.2 million euros, exports were also well above the 2019 figure (138.9 million euros).

Good long-term growth prospects

“The full order books of the German valve industry lead us to expect that sales will increase significantly in the coming months”, Burchard says. “The long-term outlook also remains good. Numerous projects in the oil and gas industry as well as the chemical industry are in the planning stage and promise good supply opportunities for German manufacturers. However, material bottlenecks combined with cost increases for intermediate products are still clouding the outlook. Despite this uncertain situation, we are optimistic and expect sales to increase by 7 percent in 2022.”