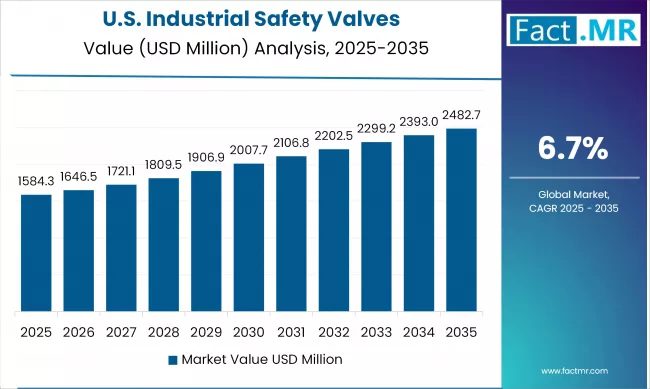

The global industrial safety valves market is expected to reach USD 10,608 million by 2035, up from USD 5,198 million in 2024. During the forecast period 2025 to 2035, the industry is projected to expand at a CAGR of 6.7%.

Text & images from Fact.MR

Industrial safety valves play a critical role in maintaining operational safety in oil & gas, chemical, power generation and manufacturing industries by preventing overpressure conditions and equipment failure. These valves support regulatory compliance, equipment protection and worker safety, with advancements in automation, smart valve technologies and predictive maintenance offering improved efficiency and reliability in hazardous applications.

What are the drivers of the industrial safety valves market?

Another key factor is the expansion of process industries that require stringent safety measures. Safety valves are essential in preventing overpressure incidents involving pressure vessels, boilers and pipelines, making them indispensable in sectors handling hazardous materials. As industrial systems grow more complex, the need for reliable safety mechanisms becomes more pronounced.

Technological advancement, including the adoption of smart valves for real-time monitoring, is also influencing the market. Applications of Internet of Things and Industry 4.0 technologies in safety valves, such as predictive maintenance, remote monitoring and automation, help reduce operational risk and enhance process efficiency.

Investment in oil and gas infrastructure, especially in emerging economies, continues to support safety valve demand. Rising refining capacity and the replacement of aging equipment across industries further reinforce market growth. Similarly, the energy sector, including nuclear and renewable power, is incorporating industrial safety valves to manage system pressure and reduce operational hazards.

Environmental protection concerns and the need to prevent leaks and emissions in chemical plants and refineries are also encouraging the use of high-integrity safety valves that meet elevated emission and safety standards.

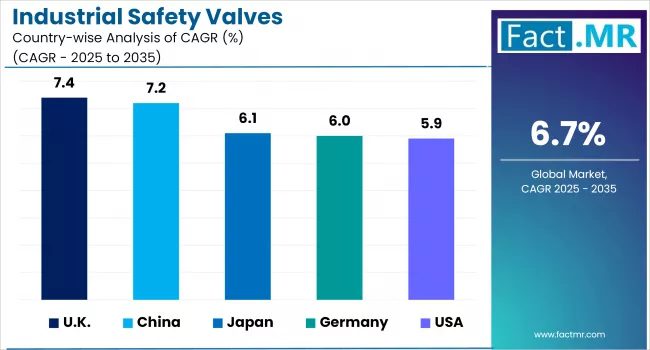

What are the regional trends of the industrial safety valves market?

The industrial safety valve market is led by North America, supported by its established industrial base, stringent regulatory frameworks and increased infrastructure development spending. The region promotes the adoption of smart safety valve technologies in sectors such as power generation, oil and gas, and water treatment, particularly in the United States. The presence of leading manufacturers and adherence to API and OSHA standards continue to support market expansion.

Europe follows closely, with countries such as Germany, the United Kingdom and France prioritising industrial safety in accordance with stringent EU safety regulations. Adoption of smart safety valve systems is supported by the region’s focus on renewable energy, nuclear safeguards and environmental protection. Germany, with its strong manufacturing base and integration of Industry 4.0 technologies, demonstrates significant use of smart safety valve solutions.

Asia-Pacific is undergoing consistent market growth, supported by accelerated industrialisation, investment in energy sector infrastructure and increasing safety awareness. India and China are key contributors, driven by demand in oil refining, chemical processing, and power generation.

Government initiatives and foreign investment in the manufacturing sector are further reinforcing growth. Japan and South Korea also represent important regional markets, characterised by advanced production capabilities and well-regulated industrial systems.

The Middle East and Africa are developing gradually, driven by oil and gas exploration, particularly in the Gulf region. Construction of new petrochemical and refinery facilities is contributing to the safety valve demand. However, economic uncertainty and fluctuations in crude oil prices may influence investment in safety-related products.

In Latin America, with Argentina and Brazil as leading contributors, industrial development and government efforts to improve workplace safety are shaping market demand. Growth in the energy and mining sectors is expanding the use of industrial safety valves.

Challenges persist in the form of uneven regulatory compliance and broader economic instability, which may limit progress in some areas.

What are the challenges and restraining factors of the industrial safety valves market?

Even though the growth trajectory remains steady, there are several bottlenecks that may challenge the industrial safety valves market in the near term. One of the primary constraints is the high cost of next-generation safety valve technologies. Intelligent and autonomous safety valves equipped with predictive maintenance and real-time monitoring capabilities are capital-intensive when considered alongside infrastructure investment and software integration, making them less accessible for mid-sized and small-scale operators.

Compliance and certification requirements present another challenge. Regulatory approvals for industrial safety valves are time-consuming and expensive, as products must meet multiple international standards including ASME, API and ISO. The complexity of certification procedures across different regions creates barriers to market entry, impacts product launch timelines and adds to operational costs.

Maintenance costs and operational inefficiencies are also limiting factors. As pressure-handling devices, safety valves require regular maintenance to ensure consistent functionality. Malfunctions or breakdowns can lead to costly downtime and safety risks. Maintenance and replacement needs contribute to total cost of ownership, which may discourage upgrades in price-sensitive segments. Moreover, supply chain instability and raw material price volatility impact production costs. Price-sensitive materials such as stainless steel, industrial alloys and elastomers used in the manufacturing of advanced safety valves are subject to fluctuation. Global shortages of semiconductors have also disrupted the production of smart safety valves, leading to shipment delays and increased costs.

Despite these challenges, the medium-term outlook for the industrial safety valve market remains positive.

Increased investment in automation, strengthened safety regulations, and broader implementation of Industry 4.0 technologies are expected to support market development. Advances in materials science, sensor integration and AI-driven predictive maintenance are expected to enhance reliability and performance, supporting continued business expansion.

Country-wise outlook

U.S. safety valve market expands amid automation and environmental compliance

U.S. industrial safety valve market is growing incrementally owing to heightened industrial safety regulation, growth in manufacturing activities and growing industrial applications of automation. OSHA and EPA’s stringent safety and environmental regulation compel industries to use high-performance safety valves.

The industry is also complemented with huge investment in infrastructure like oil and gas, chemicals and power generation sectors, where the safety valves are one of the key drivers of operational reliability. Industry 4.0 technologies like smart valves with IoT monitoring are also driving further market growth. Industrial automation and valve joint ventures are also causing market competition along with innovations.

Digital innovation and infrastructure investment drive UK safety valve growth

The British process industry safety valve market is growing with advancements in process automation technology and regulatory requirements for safety. High standards of industrial safety set by the Health and Safety Executive support demand for quality safety valves in the energy, water treatment and pharmaceutical sectors.

Government programmes to enhance infrastructure, along with investment in renewable energy projects, are contributing to market growth. The adoption of digital technologies such as predictive maintenance and real-time monitoring improves the performance of safety valve systems.

Collaborative efforts among research centres and valve manufacturers are also advancing innovation in high-performance safety valve products.

China’s high-pressure valve market heats up with local and global competition

Demand for technology-driven safety valves is rising, driven by the government’s focus on safety and strict regulatory frameworks such as the National Safety Production Plan.

The expanding need for industrial automation and intelligent manufacturing, supported by the “Made in China 2025” policy, is advancing the adoption of smart safety valve systems.

Growth in petrochemical facilities, power stations and broader infrastructure development is among the key market drivers.

Local manufacturers are scaling up production to meet rising demand, while global firms are forming strategic partnerships to strengthen their presence in China’s high-pressure industrial safety valve sector.

Category-wise analysis

Rising demand for high-performance applications drives steel valve dominance

Steel is a market leader in industrial safety valves due to its strength, corrosion resistance and long service life under high temperature and pressure conditions. It is widely used in power generation, chemical processing and oil and gas industries where operational safety holds critical importance. Investment in energy and power infrastructure, particularly in oil and gas exploration and production, is increasing demand for steel-based safety valves. The improved performance of stainless and alloy steel grades further supports their preference in operations where durability and reliability are essential. Regulatory emphasis on safety and the rising need for robust shut-off mechanisms will continue to strengthen the position of steel in this market segment.

Industrial expansion solidifies 7–25-inch valves as market mainstay

7 inch to 25 inch is the most common size range for industrial safety valves as they have their usage highly diversified across an incredibly vast array of industries. They are needed by medium to large fluid flow control in refineries, water treatment plants and chemical plants.

Higher industrial automation and infrastructural developments are fuelling the demand for these types of safety valves. APIs and ISO certifications also played a role in product design improvement, such as smart monitoring and predictive maintenance functionality. As industrialisation is increasing, the same industry is going to expand on a permanent basis as well.

Automation and reliability drive expansion of lifting lever valve market

Lever safety valves are increasingly being used with the advent of simplicity and their application in the context of precise pressure relief is necessary. The valves are used in extensive applications in power plants, chemical processing plants and boiler installations where regulated release of pressure is necessitated.

Due to growing deployment of automation and intelligent safety technologies, lifting lever valves are increasingly being integrated with Internet of Things sensing-based monitoring systems to enhance their reliability, as well as predictive maintenance enablement. Due to process safety-oriented operations, demands for lifting lever valves will continue to grow.

You can read the full summary or buy the full report from Fact.MR.

Dive Deeper into Valve World

Enjoyed this featured article from our September 2025 magazine? There’s much more to discover! Subscribe to Valve World Magazine and gain access to:

- Advanced industry insights

- Expert analysis and case studies

- Exclusive interviews with valve innovators

Available in print and digital formats.

Breaking news: Digital subscriptions now FREE!

Join our thriving community of valve professionals. Have a story to share? Your expertise could be featured next – online and in print.

“Every week we share a new Featured Story with our Valve World community. Join us and let’s share your Featured Story on Valve World online and in print.”