KPMG have released a report on merger and acquisition activities in the flow control industry for 2016.

Surinderpal Matharu, Head of Flow Control M&A at KPMG (formerly of IMI) was available for comment when contacted by Valve World:

“Oil and gas prices, alongside the softening of manufacturing activity in Asia, have created a sense of uncertainty at the start of 2016. Operators are weighing up their options and reassessing strategic priorities. We expect that subdued global organic growth, together with low oil and gas prices, will drive corporates to focus on core activities leading to non-core disposals, and debt-laden oil & gas companies will drive distressed M&A, especially those exposed to North American unconventional and offshore activities.

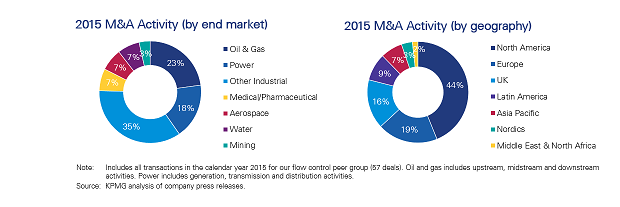

2015 M&A activity was characterised by continued sector consolidation with corporates acquiring strategic assets and disposing of non-core assets. Acquisition multiples averaged 9-11x EV/EBITDA for large to medium sized transactions, with strategic premiums being paid above that level for leading market positions and technologies. As shown, the majority of this activity was represented by acquisitions in the UK and North America, across the oil and gas and power industries.”

“2016 M&A activity is likely to remain robust driven by diversification strategies, supply chain integration, a drive for cost savings to support margins and to support shareholder returns in a softer macroeconomic market environment, valuations will however soften versus the levels witnessed in 2015.

KPMG recently advised on two notable UK valve transactions in the energy markets, which were sold to US acquirers. President Engineering Group, a manufacturer of cryogenic valves, was sold to Parker Hannifin, and Alco Valves Group, a manufacturer of high pressure valves, was sold to Graco Inc. for £72 million.”