^ Early works at the Bonny Island Train 7. Source: NLNG

Article By Ellie Pritchard

___

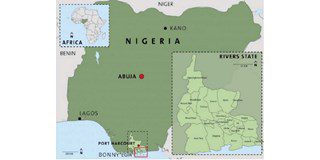

New train and new facilities

Twenty years later and NLNG is about to build train 7. In its executive summary of the project, NLNG writes that number 7 entails the following: “Construction and operation of a new complete train (known as the Complete Train, CT) and a Common Liquefaction Unit (CLU) which will take gas from the existing trains and the new train 7; and new marine facilities including a new LNG-jetty. A village will also be constructed to accommodate some of the construction workforce. The train 7 project will increase capacity of NLNG’s facility by 7.4 mtpa of LNG. The proposed train 7 project will receive feed gas through a dedicated gas transmission system and will produce LNG, condensate and LPG (mainly propane and butane). The capital investment for the project will be in the order of 3 to 5 billion USD subject to final design and scope with a design life of 25 years” (NLNG).