Mr Irawan Josodipuro is a steering committee member of the 2023 Valve World Southeast Asia Conference. He has moderated a session on the opportunities and challenges of the emerging Indonesian market, especially in the valve sector.

By Laura Wang, Valve World

At the Valve World Southeast Asia Expo & Conference 2023, an open session took place where guest speakers from the Indonesian National Oil and Gas Company and the Indonesian Ministry of Energy and Mineral Resources presented and discuss the opportunities and challenges of the emerging Indonesian market, especially in the valve sector. The moderator of the session, Mr Irawan Josodipuro, is also a steering committee member of the 2023 Valve World Southeast Asia Conference. He has worked in the field of valve pressure vessel mechanical-static piping, lead concept, FEED & detail engineering, technical audit, lead SME manufacturer assessment and qualification for more than three decades, and has extensive experience and knowledge from a user’s perspective.

He has also contributed to the Valve World SEA Conference 2023 as a panelist in the IOGP session and is credited as (co-)author for two presentation that were held at the conference: “Development of valve qualification and product technology in emerging market offshore and oil & gas Industry” and “Casting valve: challenge and solution in an emerging nations, a case study.”

What is your major challenge or demand at work? How do you deal with it?

To provide results while balancing cost and fit-to-purpose quality is a challenge. Because of increased competition within the market, price became the deciding issue, forcing the producers to compromise on quality. In the end, this will jeopardise user safety and have an impact on output.

Based on my personal experience, I deal with this as follows: First, we must define the product’s criticality. For products with high criticality, it is vital to make sure those products comply with their respective requirements. For products with lower criticality, where the risk may be mitigated, the way to go might be to compromise with risk evaluation and full mitigation.

Second, we must enlighten all stakeholders on realistic delivery times and budgeting to obtain a safe and reliable product.

Third, we must work together as a team to tackle this challenge. Another significant challenge is adhering to local content requirements. To address this, we must collaborate with all stakeholders, including the regulator, user, and manufacturer, to be able to comply with the requirements and improve the process for the benefit of all parties.

On a more practical level, what is your approach to valves?

For the preliminary method, we may conduct a survey and solicit comments to learn about valve manufacturers and product performance. However, this is not always reliable. To obtain more reliable results with a detail-oriented approach, we must undertake a comprehensive and systematic assessment considering the criticality based on the operation service where the valves will be fitted. In the oil and gas industry, valves could be classed according to their fluid service (utility, hydrocarbon, corrosive, erosive etc.), pressure and temperature range.

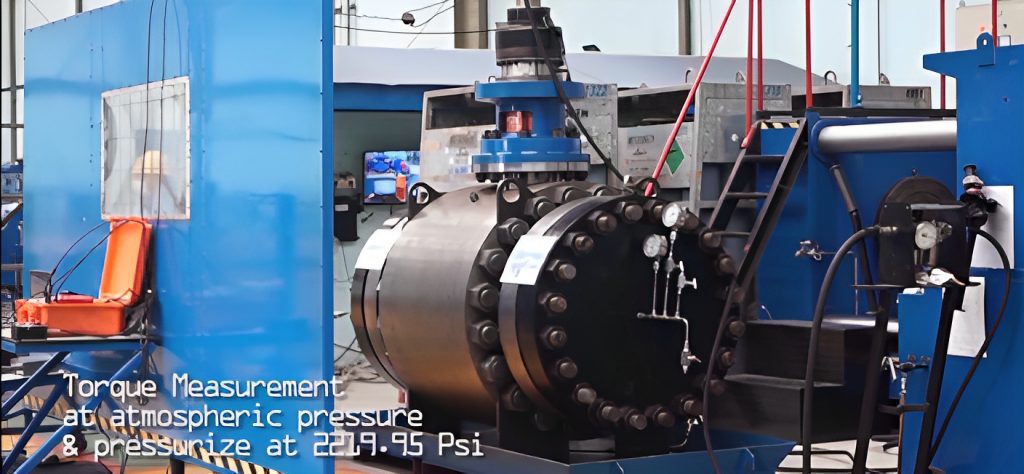

Based on this classification, we categorise the valve as low, medium, or highly critical, to correlate with the level of assessment and qualification, including prototype development, imposed on the manufacturer. By doing so, we assist the manufacturer in developing a road map for the gradual growth of their product. Then, when the product is purchased, the follow-up with feedback obtained on the manufacturer’s performance could be used for re-evaluation and improvement.

Could you indicate some of the common problems you are experiencing? How are you looking to address these issues?

The most typical problem is the inconsistency in quality. To solve these issues, it is critical to execute assessment and qualification with proper methodology prior to the purchase order, as well as monitor and manage for quality with a rigorous Inspection and test plan that follows all processes.

Basically, you get what you assess and inspect. The expertise of the subject matter expert who does the assessment and the competency of the inspector who performs the inspection are unquestionably vital in ensuring that the quality of the product supplied by manufacturers satisfies the specification requirements.

Could you mention any highlights or major success stories to date? Or could you share with us a most impressive working experience in your career?

I have received the honorary award SatyaLancana Wirakarya from the President of the Republic of Indonesia for creating an innovative methodology of assessment and qualification for valves and static equipment as engineering products to reach the international code or standard of high complexity. I have also successfully helped our local content product manufacturer to be able to comply with international codes and standards.

In the Total Energies Technology Division, where I worked with key Subject Matter Expert, I was entrusted to supervise piping valve pressure vessel/static equipment engineering, performed manufacturer assessment and technical audits for several world-class developments spanning from FPSO (Egina, MohoNord, Kaombo), LNG (PNG, Yamal), offshore, onshore, and unconventional developments. I was also appointed as Total Energies HQ’s first PVV Specialist for Total Energy subsidiaries. Additionally, I have received appreciation from international and national institutions, such as ASME (American Society of Mechanical Engineers) for my contribution as conference paper expert reviewer; The Indonesian Ministry of Energy and Mineral Resources & SKK Migas for my contributions as Coordinator Subject Matter Expert to the valve, tubular, fitting, mechanical in national capacity programme, for my role as speaker in the forum group discussion of mapping pipe and valve industry capacity, my role as speaker in a session on the methodology of assessment and qualifications; Pertamina for my dedication in expanding knowledge and contribution as speaker in the upskilling session for the Leadership Assessment Centre; and HIPMI (Indonesian Young Entrepreneurs Association) for my role as speaker in the focus group discussion for domestic industry empowerment through optimisation of domestic component levels.

Could you mention any key suppliers for valves? What are key issues when assessing such companies?

Currently, the key suppliers for valves as engineering products mostly come from Italy, whereas commodity valves mostly come from Asia; most notably China.

The key issue in assessing all the companies is the capability and capacity of the manufacturer. The key factors determined are the facility and human resources competency, R&D, the owner’s and management’s vision and attitude, and then it comes down to the technical details of different products, which are different in complexity and usage as supplied by the manufacturers. For example, manufacturing process and precision, design packages and standard variation of parts, certificates, problem-solving capabilities, sub-supplier qualification, product management, and traceability.

How do you view the status quo of the valve industry? What challenges do you see for the future of the valve market?

The public’s perception is that valves that come from emerging countries pose a high risk of quality issues. Certain countries, such as western Europe and Japan, are known to have strict quality control based on processes and procedures. However, there are also products from developed countries that are of a low quality. The manufactured products are then purchased without any qualifications; the product is trusted based on its country of origin, with the belief that developed nations warrant the quality of the product.

On the other hand, there are also manufacturers from developing nations that produce high-quality products. We need to educate the user that any product must be properly evaluated, assessed, monitored, and inspected prior to delivery.

The future of the valve market and valve manufacturing will shift to Asia. Some custom product manufacturers may remain in developed nations, but the shareholder may come from Asia.

What is your view on end user companies’ changing demands?

End users such as oil and gas companies need to standardise their specifications; for example, to the IOGP specifications. In the beginning, they will have to invest in the cost of lessons learned and product development cost. The manufacturer needs to develop and have a strong engineering and R&D team to come up with designs that could adapt to the user’s requirements and to maximise the number of interchangeable standardised parts and could meet the demands of the end users. At the end of the learning curve, both the user and manufacturer could benefit from a standardised, safe, and reliable product with an economically viable cost and quick delivery.

In your opinion, which fields have more development potential?

In the present situation, the conventional oil and gas industry is still dominating development. With the energy transition echoing around the world, we foresee valve applications such as those for clean natural gas and lower carbon energy as having development potential in the coming future. This will require more customised valves as an engineering product that could be produced in mass quantities.

How do you view the development of the Indonesian market? What opportunities can be expected by the players of the valve industry?

The Indonesian economy continues to show consistent growth. During the pandemic, Indonesia showed its resilience as one of the fastest-growing economies in the region. After the pandemic, the Indonesian economy has also shown rapid recovery.

The country has substantial energy resources, including around 1.70 trillion cubic metres of natural gas reserves, 4 billion barrels of oil reserves, 12 trillion cubic metres of coalbed methane estimate reserve, and 28 billion metric tons of recoverable coal. Indonesia has seen progress in renewable energy, with hydropower and geothermal being the most abundant sources that account for more than 8% of the country’s energy mix.

Furthermore, Indonesia has the potential for solar, wind, biomass, and ocean energy. The Indonesian government welcomes all investments into Indonesia, especially investments that bring added value to “hilirisasi”, or downstreaming, which refers to a process for increasing the added value of its goods. Commodities that were previously exported in raw form or as raw materials become semi-finished or finished goods downstream. As a result, the country’s export value is expected to be higher.

In the oil and gas industry, for example, the rapid growth of energy demand requires exploration and production, development, and maintenance of facilities to grow not only for the upstream, midstream refineries, and downstream sectors. This will make the demand for all product facilities, including valves, grow exponentially in the coming year.

For facility products such as valves, in the past, Indonesia relied on imports. In recent years, regulations have required local content. The local content policy for the Indonesian market is a means to attract not only local but also foreign investor to invest and develop a highly profitable product in Indonesia, creating multiplier effects for the economy, developing innovation and technology, producing efficiently and effectively, to cater not only to the Indonesian market but also to the international export market. With around 280 million people, Indonesia is the world’s fourth-most populous country. Together with abundant natural resources, when managed properly, the demographic is definitely a bonus that could bring a golden opportunity for investment in Indonesia, not only for the Indonesian market but also in creating value on products for export.

Recently, the Indonesian Ministry of Energy and SKK Migas embarked on a national capacity collaborative programme with stakeholders from governments, users (all national and international oil and gas companies operate in Indonesia), and manufacturers to assess, qualify and develop valve manufacturer product technology. With its high demand, Indonesia is still expecting a lot more good valve manufacturers and their supply chain manufacturers, and investments to develop the valve industry to supply the local market and export.

The challenge and solution, methodology of qualification, benefit, result, and success stories, was part of my plenary presentation at Valve World SEA 2023 in Singapore. Also present were panellists with representatives from Indonesia’s Ministry of Energy that gave the government’s perspective, Pertamina that gave the user’s perspective, and the manufacturer that gave his perspective.

About Mr Josodipuro

Irawan Josodipuro is a Piping, Valve, and Pressure Vessel Reference Specialist and Senior Engineer Project Engineering at PT Pertamina Hulu Mahakam, an Indonesian national oil and gas company. Previously, he worked for Total Energies in France as a piping valve pressure specialist. He has 31 years of professional expertise in PVV (piping, valve, and pressure vessel), including exposure to a wide range of projects, operations, and industries.

Irawan Josodipuro is a Piping, Valve, and Pressure Vessel Reference Specialist and Senior Engineer Project Engineering at PT Pertamina Hulu Mahakam, an Indonesian national oil and gas company. Previously, he worked for Total Energies in France as a piping valve pressure specialist. He has 31 years of professional expertise in PVV (piping, valve, and pressure vessel), including exposure to a wide range of projects, operations, and industries.

He holds an MSc in Mechanical Engineering from Stanford University. He is a member of the IOGP Piping and Valve Standard Committee, an ISO Piping Task and Working Group member, and a member of ASME. Mr Josodipuro is currently working on a special assignment for the Indonesian Ministry of Energy and Natural Resources as a Coordinator Subject Matter Expert.

About this Technical Story

This Technical Story is an article from our Valve World Magazine, November 2023 issue. To read other featured stories and many more articles, subscribe to our print magazine. Available in both print and digital formats. DIGITAL MAGAZINE SUBSCRIPTIONS ARE NOW FREE.

“Every week we share a new Technical Story with our Valve World community. Join us and let’s share your Featured Story on Valve World online and in print.”