The United States exported more liquefied natural gas (LNG) than any other country in 2023. U.S. LNG exports averaged 11.9 billion cubic feet per day (Bcf/d)—a 12% increase (1.3 Bcf/d) compared with 2022, according to data from the Natural Gas Monthly.

LNG exports from Australia and Qatar—the two other largest LNG exporters—each ranged from 10.1 Bcf/d to 10.5 Bcf/d annually between 2020 and 2023, according to data from Cedigaz. Russia and Malaysia were the fourth- and fifth-highest LNG exporters globally over the last five years (2019–23). In 2023, LNG exports from Russia averaged 4.2 Bcf/d, and exports from Malaysia average 3.5 Bcf/d.

U.S. LNG exports increased in the first half of 2023 after Freeport LNG returned to service in February and ramped up to full production by April. Relatively strong demand for LNG in Europe amid high international natural gas prices supported increased U.S. LNG exports during the year. U.S. LNG exports set monthly records late last year: 12.9 Bcf/d in November, followed by 13.6 Bcf/d in December. Estimate utilization of U.S. LNG export capacity averaged 104% of nominal capacity and 86% of peak capacity across the seven U.S. LNG terminals operating in 2023.

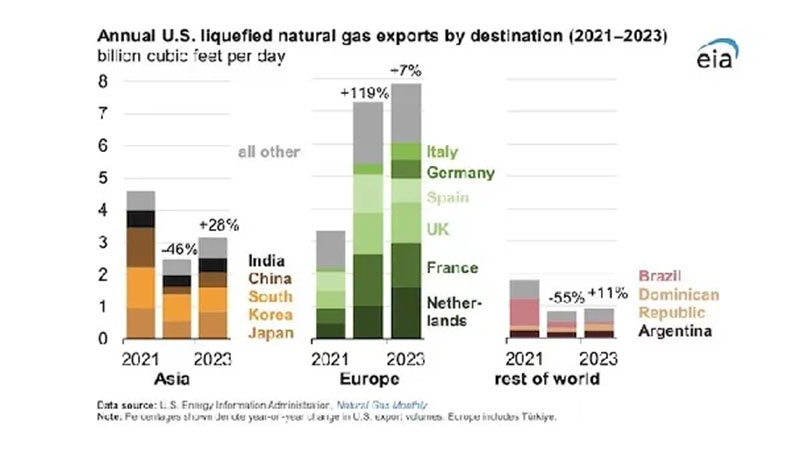

Similar to 2022, Europe (including Türkiye) remained the primary destination for U.S. LNG exports in 2023, accounting for 66% (7.8 Bcf/d) of U.S. exports, followed by Asia at 26% (3.1 Bcf/d) and Latin America and the Middle East with a combined 8% (0.9 Bcf/d).

In 2023, Europe (EU-27 and the UK) continued to import LNG to compensate for the loss of natural gas previously supplied by pipeline from Russia. Europe’s LNG import capacity continued to expand, and expect it will increase by more than one-third between 2021 and 2024.