Velan Inc. has announced major strategic initiatives that will significantly reduce operating and financial risks as well as strengthen its financial position. All amounts are expressed in U.S. dollars unless indicated otherwise.

“We believe these two transactions are key to unlocking Velan’s inherent value and we are delighted with an outcome that makes us a financially and operationally stronger company going forward. The divestiture of asbestos-related liabilities will allow Velan to confidently move ahead with the execution of its business plan while selling French subsidiaries to local interests also supports the protection of French sovereign interests,” stated James A. Mannebach, Chairman of the Board and CEO of Velan.

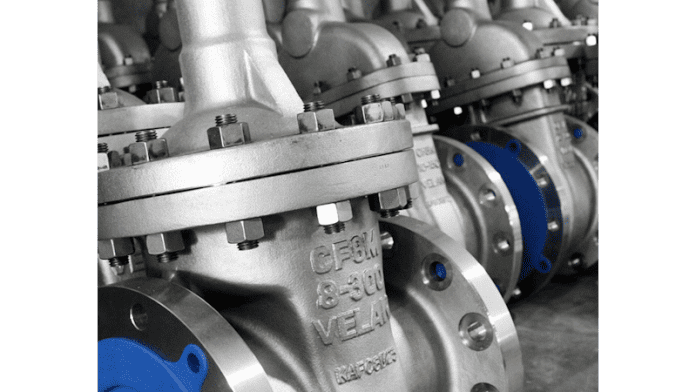

“Beyond these transactions, the Company will continue as a leader in flow control solutions for clean energy and other industrial sectors driven by its strong brand, high-quality products, and superior market positioning combined with expertise in demanding applications. Our activities will also benefit from robust momentum in the clean energy sector, including nuclear, which is undergoing a multi-year growth cycle throughout the world. We remain well-positioned in this market with our proprietary valve offerings for small modular reactors, along with our global installed base of products at existing nuclear reactors. In addition, we are firmly entrenched in other markets buoyed by global energy transition trends. Consequently, we intend to focus on executing our strategic plan and are committed to delivering sustained profitable growth. The Company continues to review options to maximize value for our shareholders,” added Mr. Mannebach.

“These transactions would meet two key financial objectives, namely the reduction of risk and resolution of our asbestos-related liabilities through the divestiture transaction and the strengthening of our balance sheet. Following their closing, Velan would be virtually debt free which would allow for greater investments in growth opportunities. Ultimately, the successful conclusion of these initiatives would offer a significantly higher value proposition to all our shareholders,” said Rishi Sharma, Chief Financial and Administrative Officer of Velan.