Current market conditions have resulted in a demand for subsea valves but the growth in this market will be determined by the comparative cost and availability of new oil and gas reserves.

By Robert McIlvaine

The demand for subsea valves is increasing due to the elevated prices of oil and gas. Over the next few years prices are likely to remain high due to the world political situation. Increases in subsea production are underway but one constraint is the long period between project start and completion. There are also uncertainties about the quality and accessibility of the reserves.

Ukrainian forces recently attacked offshore oil and gas drilling platforms in the Black Sea. International valve and other component suppliers have discontinued service to Russian oil and gas producers. The embargo on Russian oil and gas is strongly backed by the EU and many democratic countries.

Rental rates for offshore oil and gas rigs have soared, and their availability is one of the hurdles. New subsea wells require years to com-plete. In contrast wells in the Permian basin in Texas can be completed in months.

The growth in the subsea valve market will be determined by the comparative cost and availability of new oil and gas from onshore reserves.

OPEC+ agreed to boost its monthly production growth target from 432,000 bpd to 648,000 bpd recently. But oil prices actually rose. It was because of lack of spare capacity. This is due to underinvestment in new oil exploration, in large part a result of the investor shift to ESG opportunities and government policies. Across OPEC+, there are only a few countries that can actually boost their oil production.

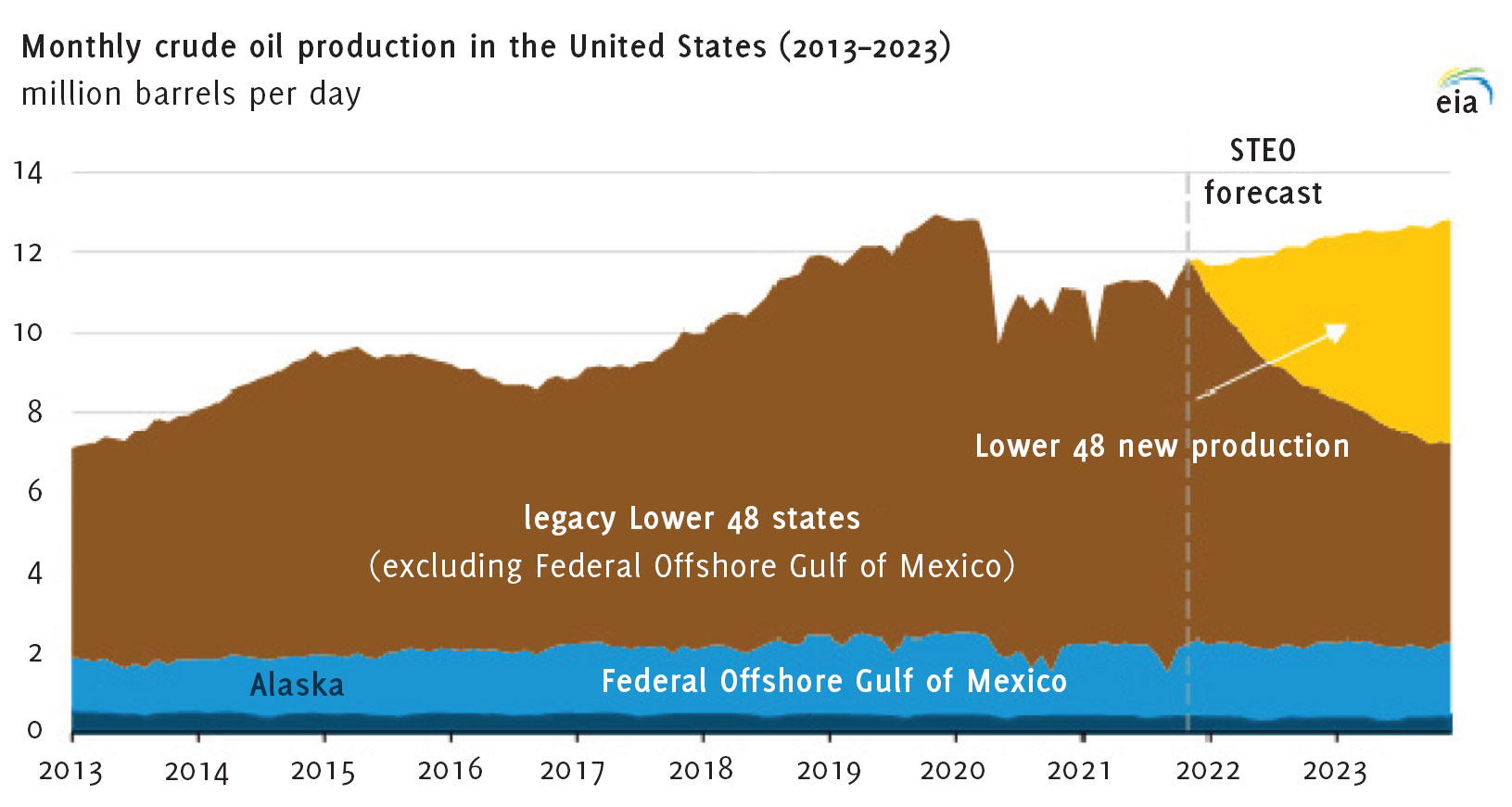

EIA forecasts that crude oil prices will remain high enough to drive U.S. crude oil production to record-high levels in 2023, reaching a forecast 12.6 million barrels per day (b/d).

EIA expects new production in the Permian Basin to drive overall U.S. crude oil production growth.

EIA expects U.S. crude oil production to increase to 12.0 million b/d in 2022, up 760,000 b/d from 2021. EIA forecasts crude oil production to rise by 630,000 b/d in 2023 to average 12.6 million b/d. More than 80% of that growth will come from the Lower 48 states and not from Alaska and the Federal Offshore Gulf of Mexico.

Production from new Lower 48 wells, particularly in the Permian region, will drive the forecast of U.S. crude oil production growth. Legacy production, or crude oil production from existing wells, typically declines relatively quickly in tight oil formations, and EIA expects that production from new wells will offset these legacy production declines.

The following factors shape the subsea valve market:

• CapEx is the leading indicator of subsea valve spend

• Major deep subsea reserves and CapEx are West Africa, Latin America, and GoM (Brazil, USA, Nigeria, Angola, Ghana).

• Development time for subsea investments averages 5 to 8 years, from exploration to first production.

• Subsea completions (wet trees) are strongly favored for ultra-deepwater basins at depths greater than 5,000 feet for reasons of cost and technological performance. For shallower waters, dry trees are favored for lower cost, direct vertical access, and established track record.

• Nearly 85% of subsea CapEx is concentrated in deepwater and ultra-deepwater basins.

• Cost curves for ultra-deepwater production are in the range of $75 to $85/bbl, which is an approximate proxy for subsea completions. Cost curves vary by geographic region reflective of “local content” requirements, as well as water depth and geologic differences.

• Key Trends: modularization and standardization of subsea equipment

• Key Challenges: cost and lead-time reductions for subsea equipment

• Subsea completions are more demanding than surface completions in terms of depth, pressure, corrosion, accessibility, reliability requirements, and other metrics, but experience has shown that technological solu-tions have been developed to meet the challenges.

• Cost considerations and technological limitations regarding dry tree technology strongly favor wet trees for the ultra-deepwater basins at 5,000 feet and deeper.

• Primary valves include full-ported gate and ball.(1) Butterfly valves with bore obstructions are not piggable and have limited application in subsea.

• Subsea vertical trees may preferen-tially reflect usage of gate valves to minimize vertical space requirements.

• Subsea horizontal trees may prefer-entially reflect usage of ball valves.

• Both tree types use ∞” to 1” small-bore ball valves for chemical injec-tions, instrument isolation, etc., with up to 30 valves per tree.

• Subsea pipelines and manifolds primarily reflect usage of trunnion-mounted ball valves

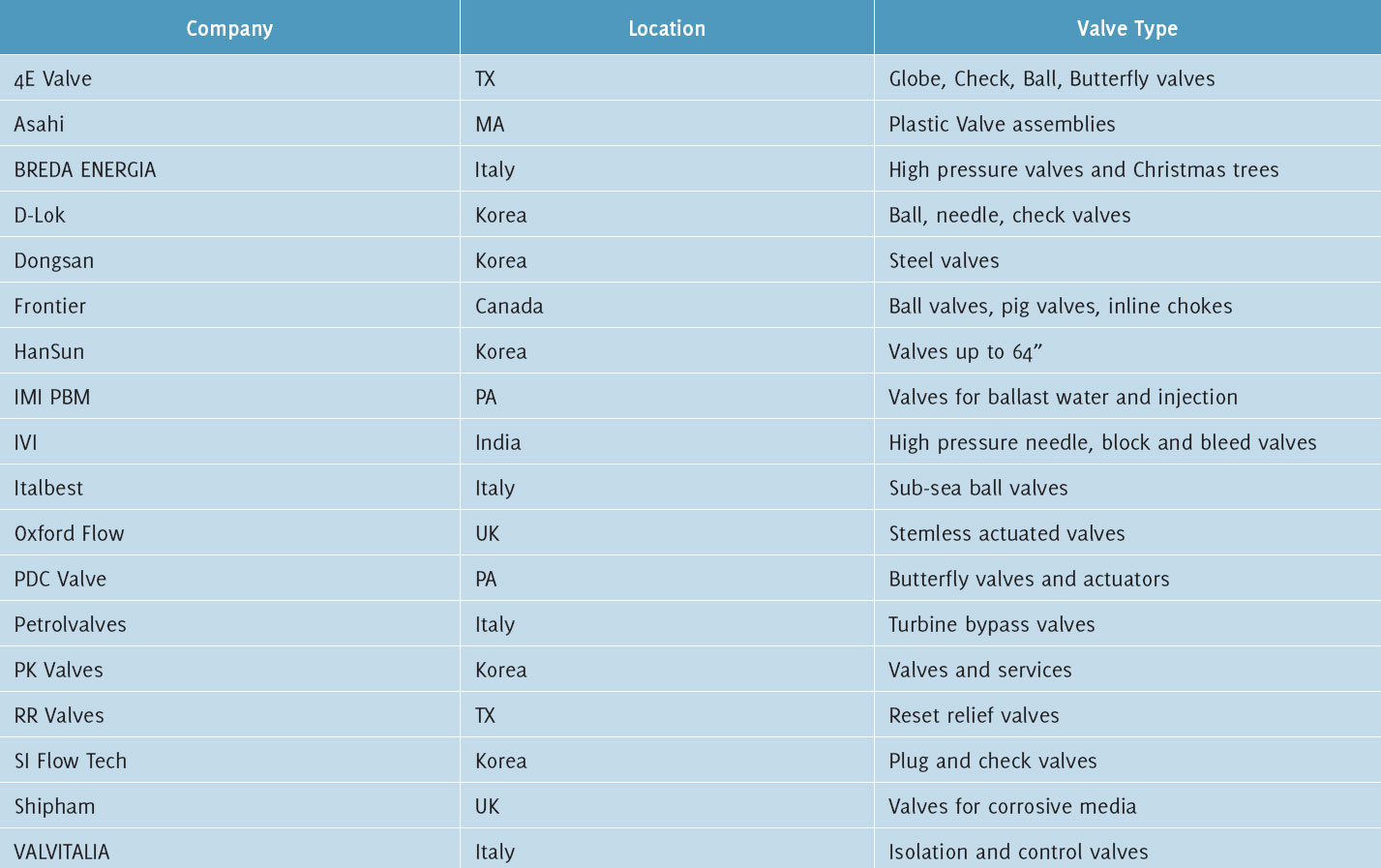

The Offshore Technology Conference and exhibition was held in May 2022. Some 25,000 people traveled to Houston. The exhibition included more than 1000 stands of which 100 were associated with valves in one way or another.

Many were distributors or suppliers of packages which included valves. There were less than 10 of the large international valve suppliers with displays. This indicates the specialized nature of offshore valve requirements.

As can be seen in figure 1 the valve exhibitors are from many countries. The large number from Korea is indicative of government support for suppliers to the energy industry. Korea had a pavilion at PowerGen held in Texas in May.

The subsea valve market will continue to be shaped by several factors. World politics will be dominant with large supplies from Russia likely to be unavailable. Another factor is the potential to increase supplies of less costly oil. The third factor is ESG. The impact of a spill in the ocean is compared to environmental impacts of tar sands with the higher energy input and pollution in converting contaminated to purified liquids.

Both the tar sands and subsea are long term investments and therefore compete for the same capital whereas shale oil is based on short term criteria.

Reference

(1) Industrial Valves: World Market published by the McIlvaine Company.

About the author

Robert McIlvaine is the CEO of the McIlvaine Company which publishes Industrial Valves: World Markets. He was a pollution control company executive prior to 1974 when he founded the present company. He oversees a staff of 30 people in the U.S. and China.

About this Featured Story

This Featured Story is an article from our Valve World Magazine August 2022 issue. To read other featured stories and many more articles, subscribe to our print magazine.

“Every week we share a new Featured Story with our Valve World community. Join us and let’s share your Featured Story on Valve World online and in print.”